Estonian E-Residency, Incorporation, Banking, Investing & Residence Permits

Why you should consider obtaining e-Residency and setting up an Estonian Company

Estonia was the first country in the world to introduce the e-Residency concept – a digital identity backed by the government. This small country on the shores of the Baltic Sea is a world leader in digital governance and is one of the most advanced countries in the world when it comes to digital innovation.

As shall be seen below, the Estonian e-Residency may be a very attractive option for those who are running an international business independent of location, would like to enter the Estonian and EU market, and can benefit from using the technology for secure digital authentication, optimized accounting and many more other benefits.

Estonia is also one of the most economically liberal countries in the world. It’s possible to register a company online in less than a day, and it is then possible to manage it remotely. The country boasts the OECD’s most competitive tax system, and profits maintained in a company or reinvested for expansion are totally tax free. Estonia is an excellent location for trade and investment, possesses a growing economy, and a vibrant ecosystem for tech startups; renowned projects like Skype or more recently TransferWise trace their roots to startups from within the country.

Estonian e-Residency

What is the Estonian E-Residency?

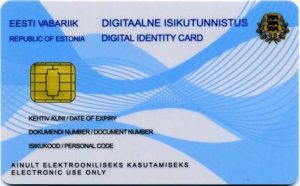

To avoid confusion, let’s start with what the Estonian e-Residency is not. It is not any type of residence permit. It does not entitle you to live or work in Estonia or in the European Union, does not represent or denote any tax residency and in no case does it lead you to Estonian citizenship. Neither is it a travel document, and it does not display a photo.

Basically, the Estonian e-Residency is a transnational digital identity card issued and backed by the Estonian Government. Based on a Platform as a Service (PaaS), it is a simple and secure system that allows you to use government portals, make secure transactions in online banks, encrypt files and sign documents electronically.

Basically, the Estonian e-Residency is a transnational digital identity card issued and backed by the Estonian Government. Based on a Platform as a Service (PaaS), it is a simple and secure system that allows you to use government portals, make secure transactions in online banks, encrypt files and sign documents electronically.

The European regulation on electronic identification, eIDAS, states that electronic identification and electronic signatures are legally equivalent to a face-to-face identification and handwritten signatures in the European Union, and was made fully interoperable in 2018. As a result, the Estonian e-residency card can now serve as online identification throughout the European community.

Since launching the program in 2014, Estonia has granted more than 50,000 e-Residencies from 157 different countries, and the Government aims to reach 10 million by 2025.

Estonian e-Residency Benefits

With the Estonian e-Residency, it is possible to incorporate and manage an Estonian company remotely, open a bank account and use Estonian online banking, access international payment processors, participate in fintech platforms securely, digitally sign documents or contracts both internally and externally, verify the authenticity of signed documents, encrypt and transmit documents securely, and file accounting and taxes online in Estonia.

The Estonian e-Residency may be especially interesting for non-EU citizens who want to do business in the old continent or to set up and manage a business of independent location. Everything can be done remotely. It might also be an interesting option to consider for British companies, as it will be a simple and straightforward way, after Brexit, to maintain operations in the EU without leaving the UK. This will allow for a maintenance of revenues, costs and financial reports in EUR, while staff can remain in the UK.

Incorporating a company in Estonia through the Estonian e-Residency program is also an interesting option for digital nomads, due to the low start-up and maintenance costs, access to the benefits of the EU’s harmonized single market, and the ability to serve clients in the EU through it.

In addition, the Estonian e-Residency serves as a secure identification for new business platforms to secure and have encrypted communications among their users, digitize business processes, invest, obtain funding or as a way to market investments in crowdfunding platforms. Possibilities are and will be huge. For example, the Estonian government is now working on a blockchain-based electronic voting system that will allow shareholders of Baltic Nasdaq listed companies to vote at shareholders’ meetings remotely, quickly and safely.

As shall be seen below, the profits of a company in Estonia are not taxed until they are distributed in the form of dividends. This is ideal for startups who will be able to reinvest their profits tax-free and grow. However, when deciding whether it is really the ideal option in terms of taxation, you should consider whether your country of residence taxes foreign-derived income, to what extent it does so, and to evaluate the existence of CFC laws and tax treaties. For these matters, it’s best to consult a tax attorney, who will be able to give you the right advice according to your specific personal and corporate circumstances.

How to get Estonian e-Residency

First, fill out the online application form with your personal data, upload a copy of the passport or ID card (EU citizens), explain briefly the reasons for becoming an E-resident and choose a card collection point. This may be any Estonian diplomatic mission or in Police and Border Guard service points of the country. Once the application is sent and the €100 fee is paid, the Estonian authorities will carry out a background check and approve or reject the application.

After between two and four weeks, you will be notified of the arrival of the starter kit containing your digital ID card and a smart card reader, at the chosen collection point. You will have to personally go there with your identification documentation, and provide fingerprints.

The card will be valid for 3 years, after which you will have to renew it and pay another €100 fee.

Incorporate a company in Estonia

Types of company

The Estonian Commercial Code establishes five business entity forms: private company limited, public company limited, general partnership, limited partnership, and sole proprietorship. The private limited company and the public company are the most used forms of entities because of the limitation of the liability of the shareholders.

- Private Limited Company (Osaühing) (OÜ): This is the most common company form. Capital divided into shares, which may be privately negotiated but not offered to the public. The company can be formed by one or more shareholders who are liable for their contributed capital. The minimum capital required is €2,500, which may be monetary or non-monetary. If the capital is less than €25,000, it will not be necessary to disburse it when registering the company. The company shall not distribute dividends until the total capital amount has been paid. The company must be managed by a board of directors, who represent and administrate it. The board may have one or more directors, who must be individuals with active legal capacity, resident or non-resident. The OÜ may have a supervisory board if it is established by the bylaws.

- Public Limited Company (Aktsiaselts) (AS): Capital divided into freely transferable shares that may be offered to the public. Shares must be registered with the Estonian Central Registry of Securities. The company can be formed by one or more shareholders who are liable for their contributed capital. The minimum capital required is €25,000. For activities such as those related to financial services, a higher minimum capital requirement may be required. The AS consists of a general meeting of shareholders, a supervisory board and a board of directors. An AS must be registered by a notary; electronic registration is not possible.

How to register a company

There is no restriction on foreigners incorporating a company in Estonia. In fact, the process is one of the easiest and fastest to be found anywhere in the world. In one day, using the Estonian e-Residency, you can establish a private limited company without having to visit the country, and can run and manage it remotely through the Internet.

To incorporate a private limited company in Estonia, you will first have to obtain the e-Residency, which has been explained above.

Any company incorporated in Estonia must have a legal address in the country, so you will have to apply for a business service provider, which will provide you with one. These providers offer legal, virtual office, accountancy, compliance, nominee directors and shareholders, among others, at reasonable prices. You can write to us at [email protected] for further information.

After that, you have to register the company electronically in the Business Registration Portal of the Electronic Companies Registry. The system generates all the necessary documents, which can be digitally signed. You will have to pay the €190 fee and in at most two days, the company will be officially registered.

A private limited company may be registered electronically in the Business Register portal only if all persons related can digitally sign, and can be created without immediate capital contribution or with a monetary contribution done online.

If you want to register the private limited company by a notary, you will have to file the bylaws, articles of association, information about communications devices, bank certificate regarding the deposit of social capital and certificate of payment of state fees. State fees through the traditional procedure are €145.

An company incorporated in Estonia is required to prepare and file an annual report containing the annual accounts and the management report, the profits distribution proposal for the year and the auditor’s report if required.

Certain activities such as construction, agriculture, gambling, education or financial services, among others, require special licenses to operate. If the annual turnover is more than €16,000, you will have to register as a VAT taxpayer. Additionally, when hiring employees, you will have to register them at the Tax and Customs Board. All the procedures mentioned, as well as the tax return, the annual report and other filing requirements can be done online with the Estonian e-Residency card.

Audit Requirements

- Public limited companies, foundations; and private limited companies meeting two of the following criteria shall be audited annually:

Net turnover of more than €2 million; Total assets of over €1 million or more than 30 employees. - Private limited companies that meet 1 of the following criteria will also be subject to audit:

Net turnover of more than €6 million; Total assets of over €3 million or more than 90 employees. - The financial statements of public limited companies, foundations; and private limited companies meeting two of the three criteria should be reviewed annually by an auditor.

Net turnover of more than €1 million; Total assets of over €500,000 or more than 15 employees. - Financial statements of private limited companies that meet 1 of the following criteria will also be subject to audit:

Net turnover of more than €3 million; Total assets of over €1.5 million or more than 45 employees.

Corporate Taxes in Estonia

Corporate Tax Basis

Resident companies and PEs of foreign companies are taxed on their distributed profits from their worldwide income. A tax credit is usually available for foreign tax paid.

Non-resident companies are taxed on income derived from Estonian sources through withholding tax.

Corporate Taxable Income

Non-distributed profits are tax-exempt, including active, passive income and capital gains. Profits distributed (dividends, shares buybacks or profit distributions through capital reductions) or deemed to be distributed (transfer pricing adjustments, payments unrelated to business activities, gifts, donations…) are subject to taxation.

Corporate Income Tax Rates

Distributed profits are taxed at a flat rate of 20% of the gross amount.

The government has announced that tax will be lowered to 14% for companies paying dividends to legal persons on a regular basis, but details have not been disclosed yet.

Dividends Income

Profits tax applies to dividend distribution, and there is no additional tax on dividends received. Redistribution of dividends may be tax exempt if the recipient holds at least 10% of shares or votes of the subsidiary, and is a tax resident of Estonia, the EEA, Switzerland or dividends/foreign PE profits have been subject to tax on a source. The exemption does not apply to dividends received from residents of tax haven jurisdictions.

Stock dividends are tax exempt.

Capital Gains

Capital Gains are taxed when distributed at the standard tax rate.

Withholding taxes

Profit tax is paid on dividend distribution and there are no withholding taxes on dividends paid to residents and nonresidents.

Interest payments to non-residents are not subject to withholding tax, but those paid to residents are subject to a withholding tax of 20%.

Royalties paid to non-residents are usually subject to a withholding tax of 10% unless the rate is reduced under a tax treaty. Royalties paid to associated EU and Swiss residents may be withholding tax exempt under the EU royalties’ directive, provided that certain requirements are met. Royalties payments to resident individuals are subject to a withholding tax of 20%.

Rental payments to non-residents on immovable and movable property located/registered in Estonia are subject to a withholding tax of 20% unless the tax rate is reduced under a tax treaty. Rental payments to resident individuals are also subject to 20% withholding tax.

Payments on professional services to non-residents are subject to a 10% withholding tax. Those paid to residents of tax haven jurisdictions may be subject to 20% withholding tax. Withholding tax is not applicable if services are conducted outside the country or from a resident of a country with which Estonia has concluded a tax treaty.

Losses

Losses are not deductible.

Transfer Pricing

Both domestic and cross-border transactions with related parties must be conducted at arm’s length. If not, then the subsequent transfer pricing adjustments are treated as hidden profit distributions and subject to profit tax. Companies, except SMEs, are required to prepare transfer pricing documentation. SMEs that have conducted transactions with tax haven entities must prepare transfer pricing documentation.

Thin Capitalization

There are no thin capitalization rules in Estonia.

Controlled Foreign Companies

Only individuals are subject to CFC rules in Estonia.

Social Security Contributions

Employers contribute 33% to the social security fund and employees contribute 2%.

Value-added tax

Value-added tax applies on the sale of goods and services at a 20% rate. Certain goods and services such as books, periodicals, hotel accommodation or certain pharmaceuticals are subject to a reduced rate of 9%.

Customs duties

Estonia is part of the European Union, and therefore trade between Estonia and other EU countries is free from customs duties. Products imported from outside the EU are subject to EU customs duty tariffs.

Property taxes

Buildings are not subject to property taxes. Lands are taxed at a rate of between 0.1% and 2.5% on the assessed value.

There are other taxes such as excise taxes on certain products, gambling tax, heavy good vehicles tax, stamp duties, and several local taxes. There are no taxes on transfers and inheritances.

Tax treaties

Estonia has concluded tax treaties to avoid double taxation with Latvia, Norway, Denmark, Sweden, Lithuania, Finland, Germany, United Kingdom, Poland, Netherlands, Iceland, Czech Republic, Canada, France, Ukraine, Belarus, Moldova, Ireland, United States, China, Kazakhstan, Italy, Austria, Belgium, Armenia, Malta, Portugal, Croatia, Switzerland, Spain, Hungary, Romania, Turkey, Slovak Republic, Slovenia, Luxembourg, Singapore, Georgia, Israel, Bulgaria, Greece, Azerbaijan, Israel, Macedonia, Isle of Man, Albania, South Korea, United Arab Emirates, Jersey, India, Bahrain, Cyprus, Mexico, Thailand, Turkmenistan, Uzbekistan and Vietnam (still not in force). You can check Estonian tax treaties at incorporations.io/estonia.

Opening a Bank account in Estonia

In Estonia, the banking sector is relatively small and concentrated. Consolidated banking assets represent around 110% of its GDP. The sector consists of 16 banks; 6 local and 10 controlled by foreign capital, of which 4 hold more than 90% market share. The total assets of the local banks represent only 8.91% of the consolidated banking assets.

The sector is in good health, as reflected in the last Global Competitiveness Report 2018 of the World Economic Forum. The country scored a total of 4.8 out of a maximum of 7.0 on its overall competitiveness, and ranks 22nd out of 140 economies. The strength of its banks was evaluated at 5.8 (28th), and reliability and financial market confidence scored 5.2 (23rd). In addition, Estonia is the least indebted country in the European Union. At the end of the third quarter of 2018, debt represented 8.7% of its GDP, an improvement on the previous year and far below the 81.2% Eurozone average.

Non-residents may open a bank account in accordance with the criteria and internal policies of each bank. In 2015 the Estonian parliament approved an amendment to the Money Laundering and Terrorist Financing Prevention Act, allowing the opening of bank accounts remotely. Although legally possible, right now most banks still require you to show up physically in the bank branch. This may change in the future with the application of information technology facilities for identification, such as a video bridge.

Estonian e-Residency itself does not represent any guarantee of being able to opening a personal or corporate bank account. It is therefore highly advisable to make sure that the bank will be willing to open your account before you buy a ticket to fly to Estonia. In addition to your passport, you may be asked for the reason for opening the account, proof of origin of funds, bank statements, reference letters from other banks or existing clients, a CV and to demonstrate a real connection with the country.

Estonian banks will be more likely to open corporate accounts for companies doing business in Estonia or the EU. Accurate accounting and a solid business plan with clear objectives are factors that may positively influence a bank’s decision. When opening a corporate account, banks may require passports of shareholders and directors, company bylaws, certificates of incorporation, certificates of good standing issued by the commercial register, a copy of the articles of association and a list of clients or potential customers.

In addition to EUR, it is possible to open accounts in several currencies and multi-currency accounts are also available. Accounts come with a debit card. Currently, with the low-interest ECB policy, Estonian banks pay interest on term deposits as low as 0.30% on average, in line with other EU countries.

Both local and international banks offer a full range of financial, insurance, accounting, and legal services at substantially competitive prices.

Banking in Estonia is mostly executed digitally; its banking sector and broader digital integration of social services, administration and economy make it one of the most technologically advanced systems in the world. Services and interfaces are safe and of great quality, and up to 98% of banking transactions are carried out over the Internet. Accounts are compatible with electronic payment providers and merchant solutions, and many of its banks are currently working with global fintech companies t0 develop innovative e-banking solutions, some of which have already been launched.

Estonia has also started to undertake the OECD’s first automatic exchanges of information (AEOI) following the CRS (Common Reporting Standard) of 2016. Estonia also has an intergovernmental agreement (IGA) Model 1 with the U.S. since 2014, to report U.S. taxpayers’ accounts and adhere to the US Foreign Account Tax Compliance (FATCA) law.

Invest in Estonia

Economic Situation

Estonia became independent from the USSR in 1990, which, as was the case in most of the ex-Soviet states, was followed by a hard transition from a socialist model to a market economy. Hard recessions throughout the decade were closely linked to the Russian crises, except for a small parenthesis between 1995 and 1997, when public investments led to some moderate growth.

It was from the 2000s onwards that the situation started to improve substantively. Local and foreign investment, industrial reconversion, investment in new information technologies combined with a responsible public spending policy and the investment of EU cohesion funds in productive sectors rather than subsidies, led to an average annual growth rate of 7% between 2000 and 2008. The standard of living increased from 45% of the average GDP per capita in the EU27 to 67% in 2008. Estonia joined the European club in 2004 and until 2008 was one of the community’s economies with higher development and growth rates.

Between 2007 and 2008, another Via Crucis took hold – the story is well known and was all too common across the world: the global economic crisis ushered in a period of increased insecurity, a decline in private consumption, a decline in private investment and demand for real estate. The situation culminated in 2008 with a collapse of export capacity and non-availability of credit. The recession lasted for the next 7 years. GDP declined -14.7% in 2009, -7.6% in 2011, -5.2% in 2012, -1.7% in 2013 and -2.9% in 2014. 2010 was the only exception during these years, where an increase in public spending and confidence among investors was generated by the country’s entry into the Eurozone, which led to a short-lived growth of 2.5%.

2015 saw Estonia regained a more secure and sustainable growth path, with a modest 1.1% in its GDP, which has been consolidated each year since. Its annul growth rate for 2017 was registered as around 1.5%. This growth has mainly been driven by an increase in domestic demand, industrial production, and exports, and is expected to level out to between 1-2% growth over the next few years.

After two years of deflation, in the second part of 2016 inflation started to grow. Although the year average inflation rate was 0.16%, the trend is upward with year-on-year increases of more than 2%. This is being driven by rising natural resource prices such as oil, falling unemployment, and rising wages, and hence consumption.

Regarding interest rates marked by the ECB, these continue to remain at 0% and are expected to stay there at least for the remainder of the year.

Unlike other EU economies, the Estonian government has always maintained a prudent budget policy. Even in the years of strong recession the budget deficit barely exceeded -2% (2009-2011) and -0.3% (2012-2013). From 2014 onwards, budget surpluses returned. Estonia is the country with the lowest public debt of the entire OECD.

Estonia is one of the most liberal and competitive economies in the world. It ranks 1st in the International Fiscal Competitiveness Index 2018 (Tax Foundation), 16th in the Doing Business 2019 Ranking, 15th in the Wall Street Journal’s Index of Economic Freedom 2019 / The Heritage Foundation, and consistently ranks in the upper echelons of the Freedom House Internet Freedom rankings, Global Competitiveness Report and in Transparency International’s Corruption Perception Index.

Investment Opportunities in Estonia

Despite its apparent obscurity, Estonia is in fact in a prime location. At the crossroads between Europe and Russia, it is nestled in one of the fastest growing European regions: the Baltic Sea. This region encompasses Scandinavia’s developed economies, northern Germany, the growing economies of the Baltic countries such as Latvia, Lithuania and Estonia, and Poland, which all border the huge potential market of Russia.

Estonia has a very favorable legislative framework for foreign investment, which accounts for an impressive 83% of its GDP. This FDI is mainly Finnish and Swedish in origin (more than 50%), with a large number of Estonian subsidiaries operating as outsourcing centers.

In addition to its strategic location and its membership of the EU, with the benefits that entails, Estonia has a highly skilled, multilingual, well-educated and flexible labor force. It is also considerably more affordable compared to its Scandinavian neighbors or Germany. Currently, the average gross salary is €1,291 per month.

Reinvested profits are tax-free. As we have seen, it is possible to create an online company in less than 20 minutes, running costs are low and almost all banking operations can be done online.

As to downsides, Estonia has a very small domestic market and purchasing power is lower than other countries in the region. In addition, Finnish and Swedish products dominate the market, so many sectors may be difficult to penetrate.

The IT sector is one of the most attractive. Estonia has one of the most developed telecommunications and digital infrastructures in the world, which offers a superior environment for business operation. The IT areas with the highest growth are fintech, cybersecurity centers, security software development, systems integration and defense software, mobile security, and wireless security. Estonia has an innovative talent pool, with a strong international reputation for know-how and innovation.

Estonia has a growing startup ecosystem in its second largest city of Tartu and its capital Tallinn. Currently, there are over 550 startups, which raised capital of more than €320 million in 2018, spread across a range of sectors, from fintech to greentech. Notable startups to have emerged from the local scene include peer-to-peer money transfer service, Transferwise, which has raised over €110 million since 2016. Other notable home-grown startups include Starship Technologies, a small self-driving robotic delivery vehicles startup, and the cloud-based sales software, Pipedrive.

In addition, Estonia is the second-ranked country in Europe, after the United Kingdom, in alternative funding per capita. In 2016, €12 million was raised on crowdfunding platforms, or €24 per person. Estonian e-Residency cardholders can invest in these platforms, signing contracts digitally. In some cases, certain requirements such as holding a local bank account or a securities account, need to be met. The most popular platforms are Crowdestate for financing real estate projects, Fundwise, an equity crowdfunding market for small businesses, Investly, for obtaining financing through advanced billing, Bondora (loans) and Estateguru (secured property loans).

Estonia is an investment destination of shared services. Both large multinational and small companies are settling in shared service centers such as customer services, IT services, finance or logistics.

Estonia boasts a large presence of industrial parks for manufacturing activities, in close proximity to ports for international shipping, and a well-developed road and rail network. Combined with its experienced, skilled and cost-efficient labor force, Estonia has emerged as an interesting investment environment for the manufacturing of fabricated metal products, industrial machinery, and equipment, manufacturing of transport equipment or toolmaking. Currently, there are 4 free trade areas in the northern coast ports of Muuga; Paldiski and Sillamäe as well as in Valga in the south-east. These areas allow for non-EU industrial equipment to be imported duty-free.

Other sectors with attractive investment opportunities are tourism, biotechnology, and green industries.

Invest in Real Estate

Foreign citizens and companies have the same rights as locals for acquiring property in Estonia. There are certain limitations for non-EU citizens, who cannot buy property on the islands of Saarema, Hiiuma, Vormsi, and Muhu, nor forest or agricultural land of more than 10 hectares.

In Estonia, as everywhere, the real estate market depends on location. The highest demand is in Tartu and Parnu, and especially in Tallinn, as they are the major cities. The average price per sq.m in Tallinn is around €1,840 for apartment space, while in the rest of the country it is just over a thousand euros. That is considerably affordable compared to other European capitals and countries.

The last two years have witnessed a relatively modest growth in prices across the country, due to a general improvement of its economic situation. However, the market now appears to be slowing, in line with the rest of the economy and due in large part to an increase in the cost of mortgages. Prices grew by just 3.5% over the entirety of 2018.

At present, long-term rental yields in Tallinn are between over 5% and 6%, well above the European average. The price of rent is rising due, among other reasons, to a decrease in long-term availability for rentals. Many investors are offering short-term rentals for tourists, where despite the seasonal phenomenon, yields can be higher.

With respect to taxes, there is no property tax for buildings, nor are there any transfer or inheritance taxes. Capital gains are included in the personal tax and corporation tax base, both at a rate of 20% (paid when distributed as dividends in the case of companies).

Living in Estonia

About Estonia

Estonia is a small country of just 45,000 sq km located on the Baltic Sea, bordering Latvia to the south, Russia to the east, the Gulf of Finland to the north and the Baltic Sea to the west. With just 1.3 million people, it is one of the least densely populated countries in Europe. Its capital is Tallinn, which is the cultural and economic center of the country, and where about 400,000 people live. Tartu and Narva, with just over 97,000 and 67,000 inhabitants, respectively, are its second and third largest cities.

The official language is Estonian, although Russian is widely spoken and there is widespread knowledge of English, especially among young people.

The climate is characterized by a very cold winter (from 1°C to -6°C on average), a short and cold rainy spring (from 3°C to 10°C), a relatively warm and dry summer (14°C to 17°C), and a cold autumn (3°C to 10°C). There are significant differences between the coastal and continental climate. Due to its northern latitude, in winter there are days with less than 6 hours of light and in the summer there are sometimes more than 20 hours of constant sunlight.

Tallinn is known for the medieval neighborhood of Vanalinn, which is a World Heritage Site, full of mansions and medieval churches that are filled with tourists in the summer. The city, despite being small, has great entertainment options to choose from, including theaters, cinemas, galleries, cultural activities, and nightlife, and has good public services and accessibility. Tallinn is a very safe city with one of the lowest crime rates in Europe. As an added bonus, it also doesn’t have much traffic, and is one of the least polluted capital cities in the EU.

Tallinn’s public transport network is formed of buses, trams, and trolleybuses. These are are almost free for residents, who just need an acquire a magnetic card which costs around €3. For non-residents, tickets cost between €1 and €3 depending on the route. With regards to the rest of the country, it is relatively well connected with a network of railways and buses. Estonia has 5 airports. The largest is in Tallinn, which currently connects the city with Athens, Berlin, Vilnius, Amsterdam, Brussels, Oslo, Warsaw, Edinburgh, Paris, Geneva, Salzburg, Helsinki, Frankfurt, London, Istanbul, Manchester, Dublin, Girona and Barcelona, many of them with seasonal flights. The other airports mostly connect with regional destinations.

Education and health are mostly public, and offer a relatively good level of expertise and service. The private health sector supply is limited, and in most cases, are linked to the public system. The telecommunications infrastructure is modern, with high-speed Internet access, as well as many free access points throughout the country, such as parks or beaches.

Estonia has many natural areas, such as natural parks, forests, rivers, lakes, and shores that make outdoor activities such as canoeing, hiking, sailing, cycling, camping or cross-country skiing (the country is mostly flat with its highest peak at just 318m above sea level) all possible.

Estonians, like most Nordics, tend to be reserved people. They are not very expressive in public situations, but they are overall honest, sincere and direct.

Regarding the cost of living, it is considerably lower than in the EU-15 countries. According to Numbeo, excluding the cost of rent, Estonia is on average 25% cheaper than Germany, 30% cheaper than France and 15% cheaper than Spain. Rental prices are also considerably low, on average 38% cheaper than Spain and 45% cheaper than in France and Germany.

Residence Permits and Citizenship in Estonia

Temporary Residence Permit

EU citizens have the right to settle, live and work in Estonia. Non-EU citizens may apply for a temporary residence permit if they settle with a spouse, close relative, for a family reunification, or to study, work or do business. In order to qualify for temporary residence, it is necessary to have medical insurance and proof of income twice the level of subsistence in Estonia. In 2019, the subsistence level is €150 per month.

To obtain temporary residence for doing business, a foreigner must fulfill one of the following requirements:

- Participation in a company, operating as a sole proprietor or investing in a business activity in Estonia, with a minimum invested capital of at least €65,000 (€16,000 if self-employed). The capital stock, subordinated liability and the amount of the fixed assets registered can be considered an investment. The permit has a duration of 5 years, renewable.

- Establish a startup with the aim of developing and launching a business model with such great, innovative and reproducible global growth potential that it will contribute substantially to Estonia’s business environment. The project must be previously evaluated and approved by an expert committee of the Ministry of the Interior. In this case, the minimum income to apply for the visa is €300 per month. The residence permit has a duration of 5 years, renewable.

- Make a direct investment of at least €1,000,000 in a company registered in the Estonian trade register, investing primarily in Estonia, or in an investment fund from which most investments are made in Estonia. The amount invested must be maintained throughout the period of residence either in the same investment or in another that meets the requirements. The investor may not be required to have a place of residence or register the place of residence in the Estonian Population Register. The permit has a duration of 5 years, renewable.

The temporary residence permit’s application fee is €160 if requested in Estonia, or €180, if requested abroad.

In Estonia, the issuance of residence permits is subject to the annual immigration quota, which cannot exceed 0.1% of the Estonian permanent population in one year. This will not apply to American or Japanese applicants or to citizens applying for residency to do research or study.

Permanent Residency in Estonia

A non-EU citizen may apply for permanent residence in Estonia if they have lived in Estonia with a temporary residence permit for 5 years, their place of residence has been entered in the Estonian population registry, they have health insurance, a permanent legal income (€300 / month) and Estonian language skills at a B1 level.

Citizenship in Estonia

It is possible to apply for citizenship by naturalization once you have lived in Estonia with a residence permit for at least 8 years, 5 of which must have been with a permanent residence permit. In addition, applicants are required to demonstrate language proficiency, pass a Constitution and Citizenship Law examination, have a permanent legal income (€300 / month), a place of residence registered and prove loyalty to the Estonian state.

Estonia does not recognize dual citizenship for naturalized citizens. Anyone that becomes a citizen by naturalization must renounce his or her previous nationality.

Personal Taxes

Basis

Residents are subject to personal income tax on their worldwide income. Non-residents are subject to income tax on their Estonian-source income.

Tax Residency

An individual is tax resident in Estonia if their place of residence is Estonia, or if they reside for more than 183 days in a calendar year in the country.

Taxable Income

Employment Income, capital gains, investment income, rental income, and royalties are subject to personal income tax. Certain capital gains, such as those from the sale of a personal residential property, are tax exempt. Certain investment income and capital gains derived from qualified securities may be exempt from tax, provided that it is reinvested.

Interest received from Estonian and EEA accounts are tax exempt.

Interest paid from certain accounts by European Economic Area (EEA) (including Estonian) banks or EEA branches of non-EEA banks to resident individuals is also exempt from income tax.

Qualifying foreign employment income, domestic dividends, qualifying foreign dividends, qualifying bank interest, and certain qualifying capital gains may not be subject to personal income tax

Tax rates

Personal income is taxed at a flat rate of 20%. Certain pension payments are taxed at 10%.

Deductions and Allowances

There is a personal allowance limit of €2,160

Unemployment insurance contributions, contributions to a compulsory accumulative pension scheme, and certain obligatory contributions to foreign social security schemes may be fully deducted from the tax base.

Certain bank and leasing interest paid to buy a personal residence, certain educational expenses, gifts and donations, and certain payments to personal pension schemes may be deducted, subject to limitations.

A 20% deduction is available for rental income from immovable property.

Conclusions

Obtaining Estonian e-Residency and incorporating a company there is definitely an option to consider for digital nomads, and more so if they do or want to do business in Europe. A company can be registered remotely in less than a day and at a low cost with minimum bureaucracy. All paperwork and tax returns can be filled online, and there is an exemption from corporate taxes, as long as profits are reinvested. If you are British or non-EU, it may be an interesting option for starting or maintaining your business in the Union. In addition, Estonian e-Residency digital authentication will soon be valid throughout the European Union.

You may also be interested in banking in the country with some of the lowest debt in the world and with the most advanced digital interfaces, services, administration and integration to be found anywhere. If so, we can introduce you to the best banks in the country. You can apply for your Estonian bank account at bankaccounts.io or email us at [email protected] for further information.

Estonia is also an option for those looking for an ideal environment to develop a tech-startup, to seek funding or invest in innovative projects. The scene is vibrant and proof of it is that, despite being a country of fewer than 1.3 million inhabitants, there are more than 500 startups, and raised €328 million in investment in 2018 alone. In addition, if your startup is approved by the Ministry of Interior, you will be able to opt for temporary residence of 5 years, after which you can apply for permanent residency.

This article is not legal or tax advice. We have access to a global network of qualified attorneys and tax advisers who can give you the proper advice for your specific case and circumstances. Contact us for further information.