What is the best offshore jurisdiction?

We’ve already discussed why corporate structures using offshore companies are powerful tools to legally minimize your obligations to governments, protect your assets, enhance your privacy and grow your business faster. Today let’s dive into 7 offshore jurisdictions / legal entities that may be of interest.

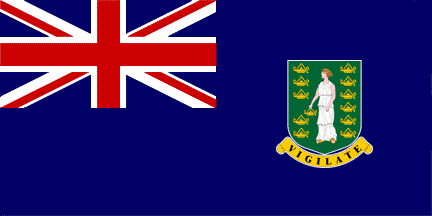

British Virgin Islands Business Company

British Virgin Islands Business Company

The British Virgin Islands has a strong offshore regulatory environment. They have a distinct combination of oversight and a laissez-faire approach which makes it both easy to do business – yet it’s also reputable with banks and other jurisdictions around the world, which makes it very simple and easy to bank and do business with a BVI company.

BVI BC companies are commonly-used vehicles for offshore savings and investments, international corporate banking, forex and stock trading, e-commerce and internet businesses, international trade and professional services as well as for holding companies, ship and aircraft registration, captive insurance, and estate planning.

Most business companies in the BVI are used as asset protection vehicles, very often in combination with a Trust as a holding company. The directors of the BVI BC may protect the assets by transferring its assets to another company, Trust, Foundation, Association or Partnership. The Directors can also merge or consolidate with any other company or can re-domicile the BC to another jurisdiction entirely.

BVI Business Companies are exempt from local taxes and stamp duty, even if they are administered in the BVI.

Corporate maintenance of BVI companies is simple: no annual meeting requirements, no financial statements, annual return filing, and no yearly audits.

Furthermore, only one shareholder and director is required, who can be the same person, and there is no minimum paid-in capital.

Cayman Islands LLC

The Cayman Islands has an excellent legal, fiscal, financial and professional environment for the incorporation of international business companies.

The jurisdiction is a world-leading offshore financial services jurisdiction due to its political and economic stability and its broad offer of banking, trust, hedge fund formation, and investment, structured finance and securitization, captive insurance and international business services.

A Cayman LLC has no company structure requirements for its management, nor are there provisions for company meetings, directors, secretaries, or capital. Its operating agreement may be arranged by its members according to their needs.

In the Cayman Islands, there are no direct taxes: no corporation tax, income tax, capital gains tax, inheritance tax, gift tax or wealth tax. Certain documents may be subject to a nominal stamp duty.

There is no exchange control and no restrictions on the movement of funds to or from the Islands.

Reporting requirements are limited to an annual return confirming that no business has been conducted within the jurisdiction. There is no need to file financial statements and audits are not required unless the company is an investment fund regulated by the Cayman Islands Monetary Authority.

LLCs also benefit from confidentiality. Details of company members are not required to be filed with the Registrar of Companies.

Companies incorporated in the Caymans also benefit from a wide range of financial and professional services. There are about 324 banks and trust companies licensed in the Islands, including 47 of the 50 largest banks in the world and high-end professional services, including lawyers, accountants, insurance managers, mutual fund managers, and administrators, among others.

The Cayman Islands LLC is an excellent entity for movable and immovable assets holding, asset protection, investment funds, joint venture companies, private equity transactions, securitizations and other corporate transactions and international structures.

Hong Kong Company

Hong Kong is a vibrant, densely populated urban center with a skyscraper-studded skyline, and is a major regional free trade port and global financial hub.

This jurisdiction has one of the most liberal, competitive and laissez-faire economies worldwide. Characterized by simple taxation with a competitive level corporate tax rate of 16.5%, capital gains and dividends free from taxes, no sales tax, and no customs duties.

Although there is no specific legislation for international companies due to its territorial tax system, a correctly structured and managed company may qualify for a 0% tax for its business carried out outside the jurisdiction.

HK is supported by a legal system derived from Common Law, which is very scrupulous in respect of private property, and an independent judicial system in which the rule of law applies to legal and contractual procedures.

With a strong international reputation, the business-friendly jurisdiction provides a great environment for establishing companies, which can be completed in one week from the comfort of your couch.

You will be required to hire a Hong Kong certified public accountant to submit yearly audited financial statements to the IRB, but prices are competitive. However, it might be useful to keep your accounts pristine and properly audited if, for instance, you are looking for funding.

Hong Kong is also one of the safest and most convenient places to do banking, as it’s home to of some of the most solid banks worldwide with the highest levels of solvency and liquidity. No exchange controls and availability of multi-currency accounts, merchant accounts, and payment processing services.

In addition, it is the gateway to one of the largest and fastest-growing markets worldwide: China. The Closer Economic Partnership Arrangement (CEPA) provides that companies incorporated in Hong Kong will have preferential access for goods and services entering the mainland Chinese market.

Hong Kong is an excellent jurisdiction to incorporate and its Ltd Co is a powerful vehicle for international trade, start-ups, internet entrepreneurs and as a holding company.

Singapore Private Limited Company

Singapore is the trading hub of Southeast Asia. Home of the busiest port in the world, Singapore is a developed country in one of the fastest growing regional economies.

Singapore is the trading hub of Southeast Asia. Home of the busiest port in the world, Singapore is a developed country in one of the fastest growing regional economies.

It has enormous potential for startups and internet entrepreneurs from all over the world. The country fosters entrepreneurship and the government supports the free market.

One of the most advantageous parts of doing business and setting up a company in Singapore is the clear and transparent tax scheme and the availability of several tax breaks and incentives for startups and technological innovation.

Singapore has a territorial tax regime which means that (in general) you’ll only be taxed on business that takes place in Singapore.

Furthermore, companies incorporated in Singapore can benefit from a broad list of more than 70 tax treaties that Singapore has concluded with foreign jurisdictions.

Private Limited companies are required to prepare and maintain financial statements and file them in their annual return to the Accounting and Corporate Regulatory Authority (ACRA) and pay the annual filing fee. Audits are only required if company gross revenue or assets exceed SGD 10M.

Singaporean companies require a local director, which may add extra costs.

There are many different government grants, incubators, accelerators, private equity funds and banks who can provide financing for your business at every stage of development.

Financing is a core component in any business and Singapore provides the best alternative investment market in the entire world.

Courts in Singapore come under Common Law jurisdiction, which is known for being speedy. For entrepreneurs who want boots on the ground sourcing from the vast resources in Southeast Asia, the Singapore court system can give them a confident backing for hiring, clear laws and a good government with low corruption levels.

The country is also an important international financial hub. Singapore is recognized as one of the world’s best private banking sectors offering top-notch corporate banking facilities and a broad range of banking services, investment funds, and insurance services, among others.

Singapore’s immigration policy is geared towards attracting foreign talent with several visa schemes to attract high-skilled foreign employees, entrepreneurs, and investors.

Singapore is an excellent jurisdiction to incorporate and its Pvt Ltd Co is a powerful vehicle for international trade, start-ups, and internet entrepreneurs. One can also obtain Residency Visas by incorporating there.

Malta Limited Liability Company

Malta is a reputable, compliant and transparent financial hub and gateway to the European Union, a market of more than 500 million people.

Malta is a reputable, compliant and transparent financial hub and gateway to the European Union, a market of more than 500 million people.

Due to its advantageous tax regime, Malta is the jurisdiction chosen by a large number of international companies and holding companies that desire to establish their headquarters and do business in the European Union.

Although its corporate standard rate is 35%, in practice there is a system of tax credits and refunds for individuals and corporate shareholders for part of the tax suffered on the distribution of profits.

The tax refund may be either a six-sevenths refund for trading income, a five-sevenths refund for passive interest and royalties, or a two-thirds refund for passive income. This may lead to a reduction of corporate tax to effective tax rates of between 5 and 10 percent – the lowest across the European Union.

Holding companies may benefit from a participation exemption. Dividend income, profits from a foreign P.E., and capital gains may be tax-exempt if the holding fulfills certain participation conditions. Furthermore, certain investments that yield a fixed rate of return may also be tax-exempt.

Malta is a full member of the EU and since 2008 has adopted the Euro as its official currency, with the benefits that it entails such as the availability of funding opportunities or European tax directives, including the Parent-Subsidiary Directive, the EU Mergers Directive, and the EU Interest & Royalties Directive.

Malta has also signed a large number of Double Taxation Agreements. Companies doing business in Malta have access to an English-speaking, highly-skilled workforce, making it even more attractive to incorporate there.

Malta costs for obtaining and administrating licenses are some of the lowest in the European Union and are often valid for the whole EU territory. This makes Malta an attractive jurisdiction to establish businesses related to e-gaming, shipping, airline or investment funds.

Malta is a reputable jurisdiction and its private company limited by shares is an excellent vehicle, whether for conducting international trade, holding immovable assets and intellectual property, conducting an e-gaming business, or as a holding group company, a ship-owning company, an investment vehicle or a captive insurance company.

You can check out further information on these and more at incorporations.io, our dedicated app to compare jurisdictions and legal entities from a tax, legal and economic standpoint.

If you are looking for personalized advice, don’t hesitate to request a consultation with one of our Senior Consultants. We will be happy to help you.

Would you like to receive the Flag Theory Master Course in your email?