We’ve hit a new level of insanity in financial markets

Bonds, savings accounts, CD’s and most traditional investment vehicles besides stock usually return under 1% growth per year to investors. Real estate is in many locations in a bubble. This week Altair Asset Management made the extraordinary decision to liquidate its Australian shares funds and return “hundreds of millions” because “This Market Is Crazy”

We’ve written about how some bonds are actually giving a negative return, which pretty much defies logic, math, and common sense. (Half a cheeseburger tomorrow, for a full cheeseburger today type nonsense).

We are seeing a complete war on cash with governments going full out to seize whatever paper-based fiat they can (because we all know, only terrorists and never normal people pay in cash).

At the same time we’ve seen a decade of quantitative easing from major central banks (US, EU, etc.) and in the case of Japan, there has been QE for decades.

The effects of quantitative easing and zero interest rate policy by central banks are short-term positive, but longer term net negative. Central banks have taken returns of the future and brought them to the present. They have pushed the risks of the present, into the future.

It’s creating a crazy environment for investment where every asset class imaginable is at all-time highs, and people are willing to invest in bonds which return a negative interest rate!

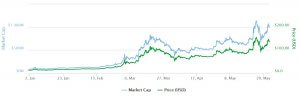

The market for cryptocurrency and ICO’s is going absolutely vertical at the moment. Bitcoin is trading at above 2000. A few weeks ago I wrote how several startups (without a product!) were raising 10’s of millions of dollars. That trend is somehow continuing, as since that newsletter a random startup (without a functioning product, only a POC) named Aragon raised 25 million in 15 minutes. Madness.

Let me say that again. 25 Million in 15 minutes, with no product. That’s a series B or C round for a developed 10-year-old company with millions of revenue type capital raise.

Why is this happening? Well, it’s enabled because of bitcoin and other cryptocurrencies such as Ethereum. These are important assets to own, and this is why we’ve made them the 7th flag of FlagTheory.

If you invested in bitcoin back when we reported it at $10, you would have 200x’d your money by now. We also recommended DASH to our customers which is on an absolute tear and has gone from $10 on January to $137 today.

However, its performance last week is a clear example of this asset class volatility. In just three days DASH depreciates from almost 152 dollars to 89. After another 3 days, it goes up to 140. This means a fluctuation of -41% and +36% in one week!

Other option to get in is buy a ‘masternode’, which costs ~$80k currently, and returns 12%*per years. This is highly speculative, and the coin could drop dramatically in price. A few short years ago master nodes were 2k a pop.

Finally, there is Zcash, which I said to buy in a few months back when it was under 50m market cap- it’s now 7x’d and is over 355.

It’s clear this is a new market class people are excited about. As always, you should be prudent and ask your financial advisor – right? Well, the problem is financial advisors don’t even know, and can’t legally recommend this asset class.

If you are reading this and are an investor, you might want to consider placing a small amount of your net worth in cryptocurrency. It’s a volatile market, but long-term – the technology is real, and the markets are trending up and to the right.

If you are reading this and are an entrepreneur, you might consider an ICO. We understand legally how to do an ICO. We’ve broken it down in this article which describes step by step what would be needed to avoid having an ICO be considered a security, and fall under the regulation of regulators around the world.

I wrote in a previous email that the cryptocurrency world is on fire. It’s still on fire, and there is no water in sight. You can compare the most popular cryptocurrencies on our beta site Cryptochi.com. If you are interested in buying or selling crypto, we can put you in touch with some reputable exchanges.

Would you like to receive the Flag Theory Weekly Letter in your email?