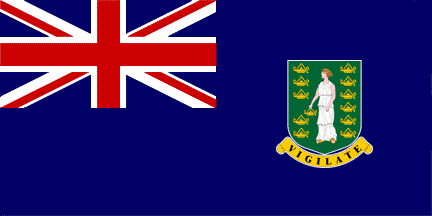

Why and how to set up an Offshore Company in BVI

When Columbus first spotted the Virgin Islands in 1493, little did he know it would become one of the wealthiest places on earth – thanks to a robust offshore environment.

When Columbus first spotted the Virgin Islands in 1493, little did he know it would become one of the wealthiest places on earth – thanks to a robust offshore environment.

When he spotted the small islands on his second trip to the Americas in 1493, he named them: Santa Ursula y las Once Mil Vírgenes later shortened to Las Vírgenes (The Virgins) and finally named the British Virgin Islands.

There is evidence that there have been some human inhabitants of the British Virgin Islands dating back to 1500 BC. When Columbus passed through, the Islands were inhabited by the Arawak. After being conquered by the Carib, the Dutch, and finally the English, the islands gained separate colony status in 1960 and became an independent autonomous nation in 1967.

The small coastal outcropping in the Atlantic has a population of only about 28 thousand, but there is an enormous amount of wealth held by corporations and trusts in this offshore, tax-free jurisdiction.

Company formation is big business in BVI; in fact, more than 50% of the Government’s annual revenue is derived from license fees for offshore companies. There are currently over 500,000 IBCs registered in BVI.

The British Virgin Islands offer distinct advantages over other jurisdictions. The most popular entity is known as a BVI BC (business company).

Why BVI?

Reputable Regulatory Environment

The British Virgin Islands are leaders in the offshore regulatory environment. They have a distinct combination of oversight and a laissez faire approach which makes it both easy to do business – yet is reputable with banks and other jurisdictions around the world. In other words – it’s not a cowboy country, but you are free to do as you please within reason, assuming your activities are legitimate and legal.

- All of this makes it very simple and easy to bank with a BVI company.

- Reputable compliance and regulatory body.

- Clear laws and established company formation jurisdiction.

Most BCs are used as asset protection vehicles, very often in combination with a trust.

Low Compliance Threshold

The Business Companies Act states that all business companies formed in BVI must establish and maintain a Register of Directors, whereby the initial director is appointed within 30 days of incorporation. Further statutory requirements are minimal and flexible.

- No corporate secretary

- No minimum capitalization required

- No local director required

- Shares can be issued for a consideration other than cash, with or without par value, and be denominated in any currency.

Simple Corporate Maintenance

- Annual Meetings in BVI not required

- No Yearly Audits

- Only one shareholder is required.

- You are permitted to run a BVI as a single directorate.

- Corporate Books, minutes and records can be stored anywhere.

- You do not need to have meetings in the British Virgin Islands; in fact, there is no statutory requirement to hold annual general meetings.

Corporate Taxes

BVI Business Companies are exempt from local taxes and stamp duty, even if they are administered in BVI. Only registration and annual license/franchise fees will apply.

Stability

The British Virgin Islands have modern infrastructure and good telecom systems. They also speak English and use a legal system derived from English common law. The BVI Government is quite responsive to the needs of offshore companies and has fostered a pro-business environment. The legislation is flexible, with the goal being to entice legitimate offshore activities, and to keep out money-laundering and other criminal activity.

4 Step Process of Incorporating in BVI

Step 1) Application form is submitted with the Company’s preferred name.

Corporation documents may be in any language. The company name shall include the word(s):

Limited, Corporation, Incorporated, an equivalent, or an abbreviation thereof.

Additionally, details of the beneficial directors and shareholders must be included such as nationality, country of residence, address, and profession. Other details, such as a professional recommendation or reference is also required.

Step 2) Due Diligence Documents Submitted

The following must be prepared for each and every beneficial director and

shareholder:

- Scanned and notarized copy of the passport.

- A photocopy of another official document (such as Driving License, ID Card etc.)

notarized. This is to ensure the passport conforms to a true likeness and that the passport is legitimate. - An original proof of residence showing the name and address of the individual is required. Most commonly this is provided in the form of a utility bill or bank statement which includes a name and address. This document must be current within 3 months.

- An original letter of introduction is required. This letter can be from a bank, lawyer, an accountant or similar profession.

- A Beneficial Owners Declaration (BOD) should be completed and signed by all shareholders and directors.

Step 3: Invoice created. Upon receipt of funds, the incorporation process shall commence.

At this point, the Memorandum and Articles of Association and any other associated documents

that have been drafted are required to be sent to the Registrar in order to qualify as a BVI IBC.

The Memorandum of Association will include the following:

- Name of the company

- Address of the registered office

- Function and objectives of the company

- Share capital of the company

- Explanation of liability

No additional documents are required for incorporation. The documents will not state the identity of the directors or shareholders, therefore maintaining privacy.

Step 4: Company formed, company formation documents couriered to a worldwide location of your choice.

After the company is duly registered, the corporate documents will be mailed to a destination specified on the order form. You can now open a bank account in a bank of your choosing around the globe, or we can introduce you to one in our network.

More About BVI companies

BVI Offshore companies and trusts are still highly relevant, although there may not be the new offerings of LLCs and asset protection trusts afforded by other more modern jurisdictions such as Nevis – the jurisdiction is far from antiquated. In fact, the age of the BVI as a tax haven seems to be a strength more than a weakness in most respects.

Bearer shares used to make an account anonymous – whereby whoever held the blank shares would control the company. Nowadays, this is essentially an exercise in futility as the registered agent on the file will always retain the name of the directors and shareholders on the company file. BVI is still about as private as you can get, and your name can’t be searched – as there is no corporate database. Just don’t believe anyone who tells you their offshore company is a ‘secret’ account. Essentially, those type of accounts is all but closed.

Why set up a BVI company if it is hard to bank in country? Because it is essentially the most popular, oldest, and most reputable offshore jurisdiction, meaning that the company documents are accepted at banking institutions worldwide. Particularly in Asia, a British Virgin Islands company is a very popular legal entity. Strolling into specific banks in Singapore, you would have no problem opening the account.

To reiterate, a BVI company is:

- Somewhat private

- Great for Fund Management

- Good for additional shareholders due to courts

- Strong, somewhat reputable Jurisdiction

- Great Banking options

- Good with Asian Banks

Form a BVI company today

If you want to consider other options to incorporate your company and open a bank account, you can check our free tools: incorporations.io / bankaccounts.io. If you need advice on how to properly structure your corporation, you may check how we can help you.