More Corporate and Tax Legislation Changes of Offshore Companies

In the previous letter, we alerted you about the massive legislative changes occurring across all offshore jurisdictions to comply with the OECD’s Base Erosion and Profit Shifting (BEPS) Inclusive Framework and the European Union Code of Conduct Group (EUCoCG) agenda.

These changes mainly affected international business company legislation, removing ring-fencing features, bringing offshore companies under local tax regimes and implementing economic substance and physical presence requirements to businesses conducting certain activities.

We informed that some jurisdictions were also adapting their local income tax regimes to keep their offshore financial industry alive. Others have announced changes, but they are not yet in force.

We reviewed legislation changes of some of the most popular offshore jurisdictions: Belize, Nevis, Saint Vincent & The Grenadines, Seychelles, Labuan, Mauritius, Barbados, Curaçao, Cayman Islands, Bermuda, and British Virgin Islands. If you haven’t had the chance to read it, you can do it here.

However, the trend to adopt legislation to OECD’s and EU’s ‘international standards’ is not only limited to the aforementioned jurisdictions. Almost all offshore financial and business centers have gone through significant amendments to their corporate and tax laws and we can expect that those that have not gone through these changes yet will do so shortly.

In today’s letter, we have reviewed another set of jurisdictions for you to discern whether your business will be affected by these massive tax and company regime overhauls.

Note that the content of this letter is intended for informational purposes and it does not constitute tax advice of any kind. The landscape is rapidly changing, we are open to consultations to see if you’ve been affected, and may need to restructure.

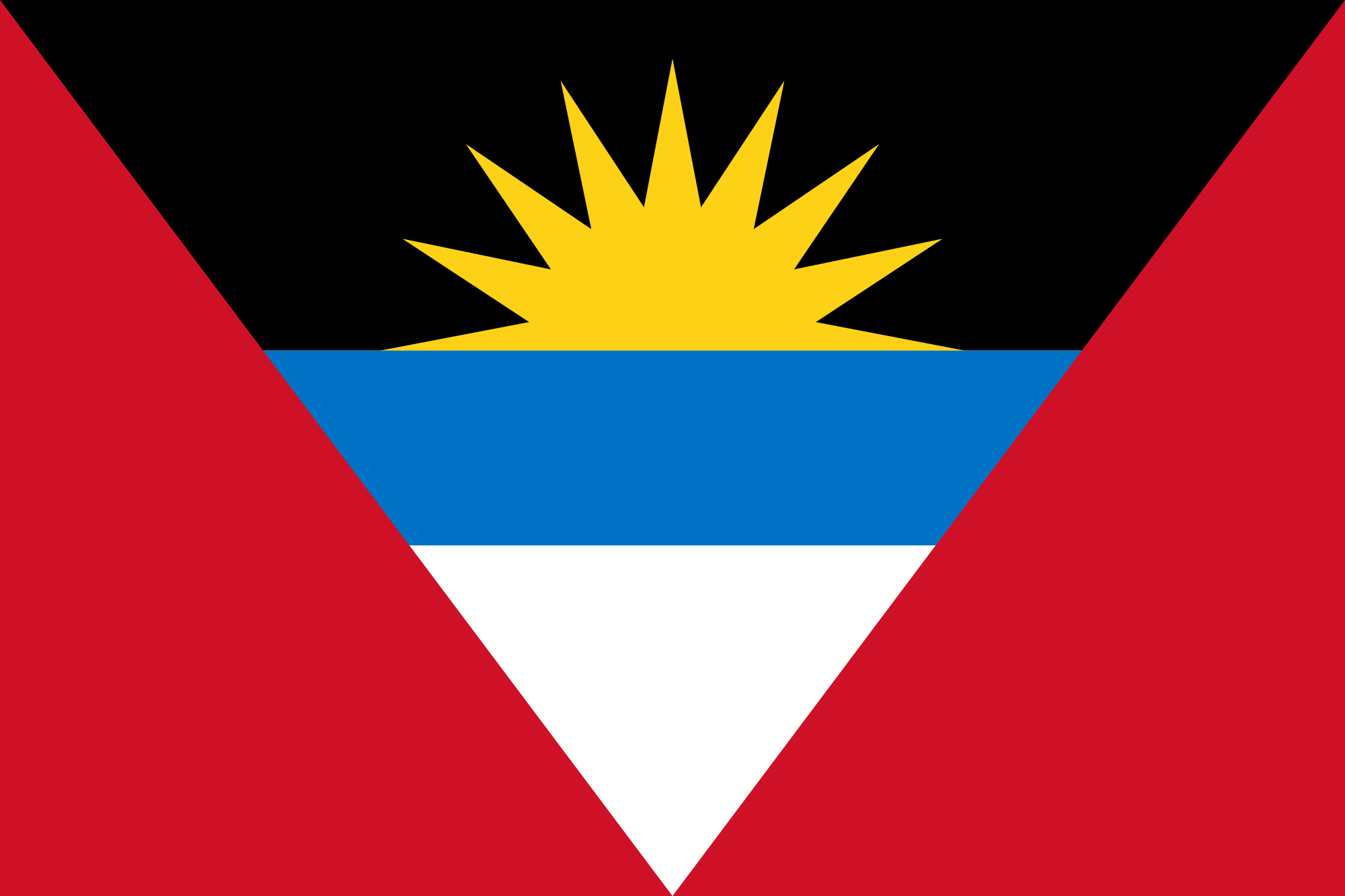

Antigua & Barbuda

In order to meet its commitments to implement BEPS standards and avoid being classified as an ‘uncooperative jurisdiction’, Antigua enacted the Miscellaneous Amendments Act in December of 2018.

The Miscellaneous Amendments Act specifically covers legislation changes to the International Business Corporations Act, the International Banking Act, the Antigua & Barbuda Merchant Shipping Act, the Investment Authority Act and the Automatic Exchange of Financial Information Act.

Now, IBCs may be incorporated by either residents or non-residents and may invest in, trade with or provide services to persons within Antigua and Barbuda provided that they apply for a certificate and registration to do so.

The Miscellaneous Amendments Act also provides an amendment to the IBC Act by deleting articles 270-281 of the IBC Act which previously provided a tax exemption for IBCs. IBCs would now be taxed at the general tax rate of 25%. No grandfathering is provided.

Banks licensed under the International Banking Act won’t enjoy preferential tax treatment and will be taxed as a local bank. Merchant Shipping business will no longer have access to the 50-year tax exemption and will be subject to a tonnage tax.

The amendment to the Investment Authority Act grants the Investment Authority as the sole entity which all concessions and incentives for investment that are or were previously offered.

For its part, the amendment to the Automatic Exchange of Financial Information Act includes the definition of a reportable person as an individual or entity to include all non-citizens and persons with dual citizenship that have been identified by another jurisdiction’s reporting financial institutions as resident in Antigua and Barbuda pursuant to due diligence procedures consistent with the Common Reporting Standard, or an estate of a decedent that was a resident in Antigua and Barbuda.

Anguilla

Anguilla has been an alternative for those looking at establishing in a British Overseas Territory but wanted to avoid crowded offshore centers such as BVI and Cayman Islands, or wanted a British territory alternative to the Nevis LLC.

Like other offshore British Overseas Territories and Crown Dependencies, Anguilla has enacted a set of laws’ amendments and regulations that provide for businesses conducting relevant activities to meet economic substance requirements: Companies (Amendment) Act, 2019; Companies (Economic Substance) Regulations 2019; International Business Company (Amendment) Act, 2019; International Business Company (Economic Substance) Regulations 2019; Limited Liability Company (Amendment) Act, 2019; Limited Liability Company (Economic Substance) Regulations 2019; Limited Partnership (Economic Substance) Act, 2019; Limited Partnership (Economic Substance) Regulations.

Domestic companies, IBCs, LLCs and LPs conducting the following activities are required to have certain physical presence requirements and conduct their core income-generating activities within Anguilla:

Banking, Insurance, Fund Management, Financing and Leasing, Distribution and Service Center (purchasing goods from or providing services to affiliates), Shipping, Intellectual Property, Headquarters, and Holdings.

Companies required to meet the economic substance test will need to be controlled and managed from Anguilla and have adequate premises, amount of expenditures and number of employees in Anguilla, according to its business activity and size. Companies deemed to be conducting a high-risk intellectual property business will be subject to enhanced substance requirements.

High-risk IP businesses are those that have acquired the IP from an affiliate and are licensing the IP to an affiliate or generating income derived from the IP in consequence of business performed by an affiliate company. For its part, holdings will be subject to a reduced economic substance test.

Companies subjected to have economic substance will be required to file an annual return reporting certain information for the regulator to assess if it has met the prescribed requirements. An Anguilla company will be exempted from economic substance if it proves its tax residency and substance in another jurisdiction.

Bahamas

The Bahamas is one of the industry veterans when it comes to offshore financial services. Since the 30s and 40s, the jurisdiction has been attracting foreign wealth due to its absence of taxation and its confidentiality policies. Although it lost popularity after its independence from Great Britain back in 1973, in favor of Cayman, BVI or Bermuda, it is still one of the go-to jurisdictions in terms of offshore corporate, trust and banking services.

Last December 2018, the Bahamas implemented several legislative changes to comply with requirements set by the EU and the OECD, by enacting the Removal of Preferential Exemptions Act; Commercial Entities (Substance Requirements) Act; the Register of Beneficial Ownership Act; and the Multinational Entities Financial Reporting Act

The Removal of Preferential Exemptions Act abolishes ring-fencing features provided by the International Business Companies Act; the Exempted Limited Partnership Act; the Investment Condominium Act, 2014; and the Executive Entities Act, 2011 – which provided companies incorporated by non-residents to enjoy certain exemptions if they were operated completely outside of the Bahamas.

Because the Bahamas doesn’t levy corporate taxes the main impact for IBCs or Limited Partnerships doing business outside of the Bahamas is that now they will be required to obtain a business license and pay a certain annual fee, as well as stamp duty on certain instruments. Limited duration companies under the International Business Act have been abolished.

Companies incorporated on or before December 31, 2018, are grandfathered for three years, until December 31, 2021.

Furthermore, international banking, insurance, and securities/capital markets sectors will be able to offer services to residents in the Bahamas and in local currency once certain regulatory approvals are in place. On the other hand, local commercial banks will be able to provide services to international clients.

With regard to the Commercial Entities (Substance Requirements) Act – in a similar fashion as Anguilla and other British territories, financial and insurance services companies, shipping businesses, IP businesses, headquarters businesses, holdings and companies providing services to or trading with affiliates will be required to meet the economic substance test.

The Register of Beneficial Ownership Act establishes obligations for registered agents to identify and verify identities of beneficial owners of companies incorporated in the Bahamas and maintain databases to hold such beneficial ownership. Information maintained in databases must remain confidential and only accessible by a ‘designated person’ and the registered agent to whom the database belongs to.

The Multinational Entities Financial Reporting Act, 2018, subjects Bahamas companies that are an ultimate parent entity (UPE) of a multinational entities group (MNE) to file a yearly country-by-country report (CbCR).

MNEs are groups that have two or more entities incorporated in different jurisdictions and that have a consolidated group revenue of over USD 850 mil.

A CbCR is an annual return that includes the key elements of the financial statements of a given multinational group by jurisdictions. It provides information to tax authorities about revenue, tax paid and accrued, employment, capital, retained earnings, tangible assets, and business activities, among others.

Dominica

Last January 2019, Dominica gazetted the International Business Companies (Amendment) Act, 2019. Under this amendment, Dominica repealed tax exemption for International Business Companies. However, IBCs incorporated on or before December 31, 2018, will be grandfathered and exempt from taxes for three years, until December 31, 2021.

IBCs incorporated on or after January 1, 2019, will not enjoy tax exemption and will be subject to the local tax regime which is currently 25% income tax on worldwide income. Amendments to the Income Tax Act are expected during this year.

Guernsey

The British Crown Dependency of the Bailiwick of Guernsey has been for decades a family wealth management hub as well as the place to be for several investment companies that are benefiting from its cell company regimes.

Guernsey has also addressed economic substance concerns of the OECD by enacting the Income Tax (Substance Requirements) (Guernsey) (Amendment) Ordinance, 2018 and the Income Tax (Substance Requirements) (Implementation) Regulations, 2018.

Guernsey tax resident entities conducting relevant activities are subject to meet certain economic substance tests such as having an adequate physical presence according to its business activities and size.

A Guernsey company would be treated as a tax resident in Guernsey if it is controlled and managed from Guernsey, or it is incorporated in Guernsey and it does not have a tax-exempt company status.

However, a Guernsey company will cease to be tax resident in Guernsey if it is tax resident in another jurisdiction, it is controlled and managed from another jurisdiction, and either the company is tax-resident in another jurisdiction due to a Guernsey tax treaty or the jurisdiction where the company is controlled and managed from has a corporate tax rate of at least 10%.

Companies carrying out relevant activities will need to fulfill substance requirements. Relevant activities are:

- Banking

- Insurance

- Fund management

- Financing and leasing

- Headquartering (provision of senior management or provision of management advice)

- Shipping Business

- Distribution and service center – purchase goods from (to resell) or provide services to non-resident affiliates

- Intellectual property business

- Pure equity holdings

To meet substance requirements, relevant businesses will need to be controlled and managed from Guernsey, conduct its core income-generating activities within Guernsey, meet the adequacy test: an adequate level of qualified employees, an adequate level of expenditure and adequate physical presence (e.g. offices) according to the relevant activity.

With respect to high-risk intellectual property businesses, like in other jurisdictions, more comprehensive requirements will need to be met.

Companies subject to economic substance requirements will need to provide an annual return to the relevant authorities to assess whether they have met applicable requirements.

Grenada

Last December, the Grenadian parliament repealed the International Companies Act, the International Insurance Act, and the Offshore Banking Act – effectively phasing out its offshore financial services industry.

Companies and businesses that were operating under the aforementioned laws may keep doing business tax-exempt until December 31, 2021.

It is no longer possible to set up an offshore company, offshore bank, and offshore insurance company – all new companies would be incorporated as domestic companies and subject to the local tax regime which has a corporate tax rate of 30% on worldwide income.

Furthermore, the International Trusts Act was also amended to forbid the creation of any new Trust after December 31, 2018. Existing Trusts will be preserved indefinitely.

Isle of Man

The British Crown Dependency of Isle of Man has also enacted amendments to its Income tax law to comply with OECD guidelines and address EU concerns.

On December 11, 2018, Tynwald (Isle of Man Parliament) passed the Income Tax (Substance Requirements) Order 2018 which amends the Income Tax Act and requires tax resident companies conducting certain relevant activities to meet certain economic substance requirements in the Isle of Man.

Generally, almost all companies incorporated in the Isle of Man are tax residents of the Isle of Man, regardless of whether they are controlled and managed from IOM or elsewhere.

Like in Guernsey and other British overseas territories, relevant activities subject to economic substance laws are narrowed to financial services, fund management, insurance services, IP businesses, shipping businesses, holdings and companies providing senior management services as well as companies trading with or providing services to affiliates.

Provisions and requirements are similar to other jurisdictions – companies must conduct its core income-generating activities in the Isle of Man, be effectively controlled from IOM, have adequate expenditures, full-time employees and physical presence within the country according to their business size and activity.

Jersey

Jersey also adopted the Taxation (Companies – Economic Substance) (Jersey) Law 201 in December 2018, requiring resident companies conducting relevant activities to meet the economic substance test.

Relevant activities and other related legal provisions are similar to those provided in other jurisdictions.

Macau

Macau has repealed the Decree-Law 58/99 – the so-called ‘offshore institution regime’. Previously, under the offshore regime, companies primarily doing business outside Macau could apply for an offshore permit that provided a tax exemption on certain income streams such as those derived from intellectual property, among other tax benefits and exemptions.

The offshore institution regime is no longer available for new entities and existing offshore institutions will be allowed to benefit from certain exemptions until December 31, 2020.

Marshall Islands

The Republic of the Marshall Islands passed in late 2018 the Associations Law (Amendment) Act, 2018 which amends and introduces certain provisions to the Business Corporation Act, the Revised Partnership Act, the Limited Partnership Act, and the Limited Liability Company Act.

The Associations Law (Amendment) has introduced a requirement to non-resident domestic entities (offshore companies) that provide financial services which would be regulated under the Banking Act (financial services providers) if the activities were carried out within the Marshall Islands – to be regulated by the relevant authority and fulfill licensing requirements of the jurisdiction in which the Marshall Islands company is carrying out activities.

In addition, it grants the power to the Registrar of Corporations to implement economic substance requirements and certain reporting requirements for offshore companies. We can expect further economic substance regulations to be enacted shortly, in line with those of other offshore jurisdictions.

Saint Lucia

Saint Lucia has also gone through several amendments of its business and tax laws to comply with requirements set by the OECD and the EU and avoid being blacklisted as an uncooperative jurisdiction.

International Business Companies (IBCs) in Saint Lucia will no longer be exclusively available for non-residents and they will be able to do business locally. Effective January 1, 2019, IBCs can be also incorporated by residents and can do business in Saint Lucia.

IBCs are now subject to the local tax regime. However, Saint Lucia has also passed several amendments to its tax laws to switch to a territorial tax system. All companies, including IBCs, will be taxed at 30% corporate tax on income from Saint Lucia-source and will be exempted from taxation on income from foreign sources.

Foreign-source income is defined as follows:

- Profits derived from a permanent establishment outside of Saint Lucia

- Profits derived from immovable property situated outside of Saint Lucia

- Interest income not borne by a Saint Lucia permanent establishment or charged against property located in Saint Lucia

- Income derived from investment in securities issued by a person outside of Saint Lucia, e.g. mutual funds, stocks, bonds, etc.

- Management charges paid by a nonresident outside of Saint Lucia

- Royalty payments received from a foreign permanent establishment and paid to a resident permanent establishment.

- Any income deemed to be accrued from foreign sources due to a DTA.

Dividends and capital gains are also exempt from taxation in Saint Lucia.

IBCs conducting certain economic activities will have to meet certain substance requirements – including an adequate number of employees, adequate operating expenditure, adequate investment and capital commensurate according to the activity, as well as file annual tax returns, among others.

IBCs incorporated before December 1, 2018, will be subject to the previous IBC regime until June 30, 2021.

The International Partnerships Act and the International Trusts Act, have also been amended to prevent new registrations since December 1, 2018. International Trusts and International Partnerships registered before December 1, will be grandfathered until June 30, 2021, subject to certain conditions such as the prohibition for trusts to acquire new assets or carry out a different purpose.

Note that on February 6, 2019, the EU Code of Conduct Group (Business Taxation) wrote a letter to Saint Lucia requesting further amendments to its tax regime before December 31, 2019.

According to the EU Code of Conduct Group, a tax-exemption on transactions conducted with non-residents is considered a ring-fencing feature and therefore a harmful preferential tax treatment. We will update you as soon as there are further developments on this matter.

Turks & Caicos

In a similar fashion as the BVI, Cayman, Bermuda and other British territories, the Turks and Caicos introduced the Companies and Limited Partnerships (Economic Substance) Ordinance 2018, implementing economic substance requirements for businesses conducting relevant activities.

In addition, it has passed an amendment to the Banking Ordinance, introducing physical presence requirements as well as explicitly prohibiting the operation of shell banks within the jurisdiction.

Vanuatu

As we advised in our article ‘Where to set up a Securities Token Exchange’, Vanuatu has also updated its financial services and companies legislation.

On January 9, 2019, the Financial Dealers Licensing (Amendment) Act entered into force, which has brought a substantial increase on licensing and ongoing fees and physical presence requirements, has set 3 type of licenses, a minimum insurance coverage, as well as other reporting and licensing requirements.

The amendments now separate dealer’s licenses into 3 different categories namely Class A Principal’s Licence, Class B Principal’s Licence and Class C Principal’s Licence. A Class A Principal’s License allows to deal in debenture stocks; or loan stock, bonds; or certificate of deposit; or proceeds of Foreign Exchange. Class B Principal’s license allows dealing in future contracts and derivative products.

For its part a Class C Principal’s License allows a licensee to deal in shares in share capital of a corporation; or proceeds of precious metals; or proceeds of commodities; or a right despite whether or not conferred by warrant, subscribe for shares or debt securities; or a right under depository receipt, an option to acquire or dispose of any security or a right under a contract for the acquisition of securities

There is also an obligation for the directors or managers of the licensee to normally reside in Vanuatu for 6 months within each year, and have at least 5 years’ experience dealing in securities.

Licensees must have a physical premise in Vanuatu to maintain the following systems: a failing system; a management and accounting system; a business continuity system; a software system and server.

The minimum insurance coverage for each licensee must be of VT5,000,000 for each claim, with an aggregate cover of not less than VT50,000,000 and a maximum deductible amount of VT500,000.

Licensees must now file annual audited accounts.

The transitional period for existing licensees to apply for a license renewal according to the new legal provisions ends on July 7, 2019.

However, the Vanuatu Financial Services Commission (VFSC) has expressed that they want to provide flexibility to new and existing licensees to meet the new requirements and will pass further amendments to extend the transitional period for another year and to lower certain requirements provided by the new legislation. We will keep you updated.

The Bottom Line

As we commented in our previous letter, the offshore financial services industry is quickly changing and becoming more transparent and subject to more requirements. The offshore company business type with no (reported) tax residency, no filing requirements and completely private might have its days numbered.

However, pressure from international organizations, namely the EU and the OECD, is fierce and the situation remains unsettled. This adds a level of uncertainty, especially for those that do not qualify under grandfathering provisions.

A few days ago, we saw the EU Code of Conduct Group sending letters to Belize, Seychelles, Curacao, Barbados, Mauritius, and Saint Lucia authorities – stating that their recent legislative amendments are not enough and their new regimes still bear ‘harmful’ features – and urging to address them before end of year.

This leads us to believe the EU is not happy with certain offshore jurisdictions merely switching to territorial tax or low tax systems and that certain anti-avoidance measures such as CFC and/or additional reporting requirements may need to be applied. We can expect further legislation changes – which scope remains to be seen.

Not only have offshore jurisdictions gone through significant changes during the past months – onshore jurisdictions are also adapting their tax regimes via introducing controlled foreign company rules, interest deductibility limitations, requiring substance to qualify for certain foreign-investment tax incentives and intellectual property tax regimes as well as modifying transfer pricing rules and reporting requirements, and phasing out certain preferential tax regimes. In the next letter, we will cover some of these onshore jurisdictions.

International structuring opportunities are there – and one can also benefit from attractive opportunities in ‘onshore’ or ‘mid-shore’ jurisdictions. For certain businesses, it may make sense to restructure your company towards this end, as it may also bring certain benefits.

At Flag Theory, we have always advised on and worked with our clients on the importance of setting the proper corporate and personal tax residency, corporate governance, proper commercial substance in business relationships and transfer pricing arrangements within elements of a given group structure – and how these are key elements of a sound, bulletproof and compliant corporate structure, and tax minimization plan.

It’s clear more than ever that structuring is an evolution, and one must adapt and pivot alongside the laws and regulations. It’s worthwhile to consult with professional advisors who are aware of these changes and can advise you accordingly.

A fully customized approach when it comes to corporate structuring is necessary more than ever – by analyzing and considering your particular business needs, your business activity, your suppliers and clients’ location, controlling persons’ tax residency status and many other variables.

At Flag Theory, we can help you with adapting to these massive changes in the offshore world. Contact us today, and we’ll make sense of the changes, come up with a plan, and leave you better positioned to handle whatever comes your way.