Doing Business in Japan

Sushi, The Yen, Salarymen, Usemu, Matcha Latte, Sayounara, Scramble Crossing, Shibuya, Roppongi, Tokyo, Japan.

Sushi, The Yen, Salarymen, Usemu, Matcha Latte, Sayounara, Scramble Crossing, Shibuya, Roppongi, Tokyo, Japan.

こんにちは Konnichiwa from Tokyo where I’m here for business and pleasure on this fall weekend in Japan.

In the impossibly large capital city, one is instantly taken aback not by the size, but how clean and safe one feels. In November, the weather is cool and the leaves are yellow and red. The sea of Japanese people is stylishly dressed in scarves and jackets, hurrying quickly from place to place. I’m off to meet a friend and fellow entrepreneur, and during my meetings, I’ve taken notes for your benefit.

I have not lived long term, or first hand set up a company in Japan (and normally the articles I write have some first-hand experience). This is meant as a primer for doing business in Japan, a starting point. However, I believe that brighter opportunity lies outside Japan in more developing markets.

The true benefit of planting a flag here would be for lifestyle purposes. If you are waiting for an awesome and strategic reason to visit Japan – I won’t be able to give one. In fact, the only bet I could recommend making is a bet against the Japanese economy.

The country is not on an upward trajectory. Perhaps in the short term they will maintain G20 status as the 3rd largest country in the world. However, in the long term, the country has some serious underlying problems that won’t be easy to change. When I sat down with Jim Rogers at his house in Singapore he echoed this sentiment.

However, let’s say you are interested in moving to Japan, or living here longer term – what flag should you plant?

========

Flag Theory in Japan

Citizenship in Japan

Japan does not recognize dual nationality and thus if you wanted to become a Japanese citizen and receive a passport from Japan – you would be required to renounce all other citizenship. It’s also quite difficult to become a Japanese citizen – you’d need to be fluent in the language and achieve some level of status in society.

Residency in Japan

Residency can be applied for if you live in Japan for 10 years or more. This is known as a Permanent Resident visa.

If you are approved as a Highly Skilled Foreign Professional (HSPF), you may apply for Permanent Residency after 4 years and 6 months from the date you were approved as an HSPF, but if you happen to be the spouse of a Japanese national, an approval can be granted after 3 years. [UPDATE: Effective since March 2017, Highly Skilled Foreign Professionals scoring 70 points may apply for a permanent residency after 3 years of residence. Those scoring over 80 points may apply after just a year. Scores are based on professional qualifications, education level, and annual salary]

If you absolutely must establish residency in Japan (which I would caution you not to – due to the country’s CFC laws covered below), here are a few visa options which would be possible:

tourist visas

tourist visas- employment visa

- investment visa

- entrepreneur visa

- marriage

Tourist Visas

To live in Japan as a tourist is relatively easy depending on your passport situation. For instance simply by arriving many western countries have 90-day visa-free access due to reciprocal visa arrangements. Japanese immigration policy is fairly open to all G20 countries and opening up to other countries as well (the Thailand policy just changed for instance).

While here, I met one individual who has managed to live over a decade in Japan on tourist visas because he has multiple passports. This is one of the side benefits of having a second passport – you essentially have two different identities, that allow you visa access to certain places beyond normal timelines.

Employment Visas

If you are going to work for a company in Japan, it is likely that the company will handle all of your paperwork. This is an interesting route, especially if one wanted to make a go at permanent residency. This is because…

Status of residences follow employees, not jobs. If you are, for example, an engineer, you can quit your job as an engineer and get any other job without requiring a review of your immigration status… as long as that new job is in the same status of residence. This is very important.

The most common way to licitly start a business in Japan as a foreigner is to arrange to work with a Japan-based employer, get one’s status of residence through the employer, work for a time, quit, and then go into business for oneself in the same field. Although it isn’t exactly encouraged, the regulations for e.g. engineers don’t disallow you from being an engineer for a variety of customers including e.g. an entity you just happen to own. This means that you have from the time you quit to your next renewal of your status of residence to figure out how to either e.g. justify an entrepreneurship status of residence or fulfill the three prongs of your existing professional status of residence. (“Continued stable employment, at a Japanese organization, as demonstrated by contracts.”)

.su-row{margin-top:10px;border:1px solid #ccc!important;padding:15px;padding-bottom:10px;-webkit-box-shadow:0 0 5px 5px #D1D1D1;box-shadow:0 0 5px 5px #D1D1D1;}.entry-header,.entry-footer,.archive-title{margin:0 auto;padding:0 0 0 0!important;}

My hack around this, after quitting the day job, was to describe myself as an engineering consultant. I presented the immigration office with a stack of invoices and tax returns demonstrating that I made a stable living in software. (Much of it was from selling software, the key bit from their perspective was that at least one of my contracts had a Japanese company as a party to it.) After a bit of wrangling, they approved me to continue doing what I was already doing. (Word to the wise: this trick for self-sponsorship doesn’t technically speaking allow one to “run a company”, so I would avoid doing things which make it undeniable that one is in fact doing that, like e.g. hiring full-time Japanese employees.)

There exists a new status of residence for highly-skilled professionals which may make this somewhat easier than the business manager status of residence (which is achievable but has toothy requirements, like having 2+ full-time Japanese employees and at least ~$500k in capital).

http://www.kalzumeus.com/2014/11/07/doing-business-in-japan/

Investment Visa/ Entrepreneur Visa

It will soon be possible to obtain an entrepreneur visa in Japan. The government is also changing rules around this in 2105 so it’s a reasonably good time to undertake this mission, as it used to be much harder. [UPDATE 2017: An Investor / Business Manager Visa is available for foreigners who will undertake senior roles in a Japanese company and for those who incorporate a company with at least JPY 5 million of paid-in capital]

The “entrepreneur visa” will have easier requirements for companies setting up the new Special Economic Zones, slated for Tokyo, Osaka (medical focus), and Fukuoka.

Similar zones in China have proven to be a success in setting up a business. As of now, the requirements are not clear, but surely they will be a lot easier than the minimum for equivalent U.S. EB-5 Immigrant visas, which require hiring 10 people and an investment of between US$500,000 and US$1,000,000.

Marriage

I met one expat who was very forward in telling me he was here for 8 years already, had learned the language, and would soon “inherit” the business from his wife. He did not seem very enthusiastic about this, and I figured this is because the business seemed rather drab and focused on the Japanese funeral industry. Once I met his wife, I realized that it was not the business which made him depressed, but rather her appearance (or lack thereof). Jokes aside, he can now apply for permanent residency through marriage.

Set up a company in Japan

One would need to form a company in order to get an investor visa. While it used to cost thousands of dollars to set up a company in Japan, that has changed slightly, and 株式会社 can be formed with 1 yen in capital. However, in order to get an Investor visa, you’d need a commitment of about US$50,000. It should be noted that very little will need to be spent on human capital (minimum of 2 nationals) or an office, but this is AFTER the 3-year visa is issued.

However, the Japanese government has identified visas as an item to be further deregulated, and the entrepreneur visa listed above will probably present alternative options. We will update this article once the guidance around that visa is more clear.

CFC Laws and Taxation

Doing Business in Japan with an Offshore company is an interesting opportunity. From my outsider and unofficial understanding that you should not rely on, the Japanese authorities give you a 5-year tax break when you are a resident in Japan. Although there are CFC laws like other G20 countries, they seem to not be as investigative of people living in Japan and operating through foreign entities.

However, that is not to say the laws don’t exist! For instance, we found at least one law that maintains: if the main business of a foreign company is the holding of shares, capital or debt of other companies the foreign company cannot be excluded from the application of the THCML rules (Japanese CFC rules) on grounds of business activity. Therefore, it would be better to send all the profits through the offshore company (and have the company be active outside Japan, instead of just holding shares). It also makes sense to take a close look at the shareholding of each entity as it relates to taxation by Japanese authorities.

If one had the proper shareholding in the foreign entity (which captures the bulk of the cashflow) the owner could then use the Japanese company for a small salary and visa, and keep all other profit outside. There is some opacity to whether this would be strictly legal for a foreigner to do, depending on what visa, tax status and residency one held.

This is another problem with Japan laws – they are not always clear and reading through a translation of the tax code revealed much uncertainty. For me, this is another reason why I wouldn’t feel comfortable being a long term resident in Japan and running significant income through offshore companies. There is ambiguity in personal finances, an area I would prefer to have in order and completely black and white.

Banking in Japan

It is almost impossible for a foreigner to set up a personal bank account in Japan. If you wanted to walk in off the street on a tourist visa and didn’t speak any Japanese – you are not opening an account.

As with most things offshore, banking or sovereignty, if you want it badly enough – it is possible! The more connected you are in society, or the better you speak Japanese, the better your chances. My entrepreneur friend told me a story that he once tried to open an account, only to be continuously denied. When he called up and spoke fluent Japanese over the phone, the banker told him to try one more time and the account went through.

Needless to say – it’s not a noteworthy flag anyway, due to the high rate of inflation of the Yen. However, if I could find a way to get a loan in Japan, and invest that money in another faster-growing economy, I most certainly would.

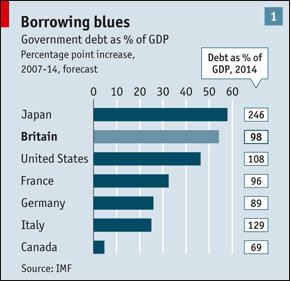

Japan is the only country in the world which is more overburdened in its National Debt to GDP ratio. That is to say, they are so fiscally irresponsible with their balance sheet, that their GDP to debt is currently 247% and rising. The counter-argument to this is that most of the debt is held domestically, that is to say, that local pension funds, mutual funds, private investors etc. will invest in Japanese bonds.

Property in Japan

Physical Land / Assets – there is a lot of potentials to cater to foreigners (ala Airbnb) for doing business in Japan, and unlike many other Asian countries, there are no legal restrictions to buying real property or land in Japan. The transaction costs do tend to be quite high, and probably the biggest risk is some sort of natural disaster (which seem to be common) or longer term deflation of your asset.

| Transaction Costs | ||

| Who Pays? | ||

| Agent’s Fee | 5% | buyer |

| Acquisition Tax | 4% | buyer |

| Registration Tax | 2% | buyer |

| Stamp Duty | 0.01% – 0.20% | buyer |

| Legal Fees | 0.10% | buyer |

| Real Estate Agent’s Fee | 3.15% + JPY63,000 (US$620) | buyer |

| Costs paid by buyer | 9.26% – 9.45% | |

| Costs paid by seller | 0% | |

| Total Transaction Costs | 14.26% – 14.45% | |

| Source: Global Property Guide | ||

Before the deal, a Juyoujikou- Setsumeisho (similar to a Property Disclosure Statement) is drafted by the real estate agent. The purchase contract is drafted once a deal is settled. It is customary that a ten percent deposit would be made by the buyer prior to the closing date.

The title would be transferred during closing with both parties obtaining certificates with a sealed impression. After closing, stamps are obtained, as well as all government fees and taxes paid to register the title, with the last step being the payment of any remaining balance.

I’m not recommending one go and buy physical land in Japan, but I’d rather hold the land then Yen – and there were some reasonable investment opportunities from my research.

One Flag I would feel comfortable planing in Japan would be for personal or data security. Houses tend to have very strong security measures and overall the country allows you to live a very private, safe life. However, planting flags is more about leaving a flag planted so that you can travel around, not being tied down to a place. Furthermore, I’m not bullish on the Yen in the long run – so I wouldn’t recommend something like opening up a bank account for exposure to the Japanese Yen.

What follows are some reasons why I think you shouldn’t invest or locate yourself in Japan.

Japanese Decline

Aging Population

Japan is a very old society, the average age is 42.6 and is the second oldest country in the world trailing only Monaco (which is a great place to set up residency) yet they are reproducing at the lowest rate in the world.

Doing business in Japan

The main reason I am not bullish on Japan is the tendency to do things the way they always have been done. For instance, if one is going to climb the corporate ladder in Japan, it could take 20 years or more until one is at a high position in the company. It might not be inherently bad to have experienced people running a company, but when you consider the broader macroeconomic factors (Japan’s aging population and ultra-low birthrates) you can see that there are going to be problems in management. The country is also somewhat (not completely) insular and xenophobic, so it’s not like they are going to go out and hire qualified foreigners to run the companies either.

Startup Difficulty

Startups are perceived as ultra-risky in Japan, and the country is so used to having large companies provide for everyone – it would be easy to see how a disruptive company coming into a nascent industry could easily be perceived as a threat. There do seem to be some entrepreneurs who have been able to overcome the difficulties of doing business in Japan. In addition to Patrick Mackenzie’s blog (listed above) you might do well to check out venturejapan.com or beaconreports.net which both seem to have very interesting opinions and experiences on doing business in Japan.

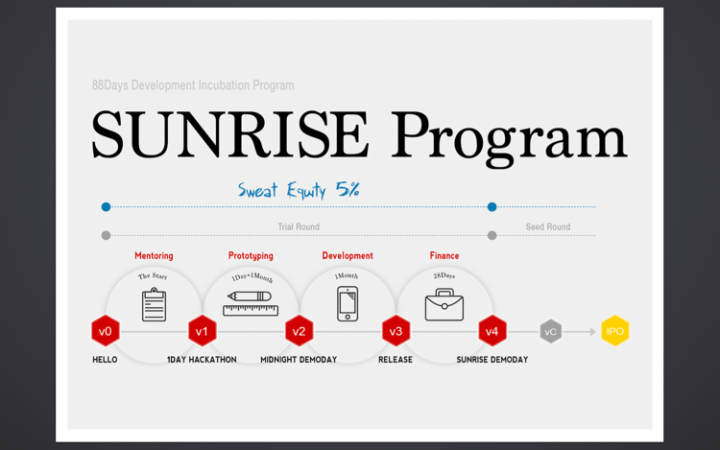

There are some investors in Japan; quite a few actually. Many are interested in investing in South East Asia as a region. This is probably because they want to make the same hedge bet that I do – loan money domestically in Japan and invest internationally in faster moving economies. These tend to be at the series A round and beyond. There are some incubators which offer to take 5% sweat equity in exchange for $0 in funding. Overall, the ecosystem is not developed. The country as a whole is still very important on a global scale – but it seems very difficult to launch a startup in Japan.

Language

It is absolutely necessary to learn Japanese if you want to work long term in Japan. It might be worthwhile to learn Japanese and you might find that the barrier to entry actually creates some interesting opportunities for you. However, I couldn’t really reach a consensus amongst expat friends whether this was a good idea. Many seemed convinced that one would always be an outsider and it was a waste of time to do business with the large, slow-moving Japanese companies.

Weaknesses or Strengths

A weakening currency, and aging population, depleting natural resources, huge national debt, an insular economy and high barrier to entry. Japan is not a place I would want to place a flag (unless I just loved the country, and it was a lifestyle flag).

If I wanted to live in a safe place, wasn’t concerned about location for business purposes, and felt comfortable using an offshore company and banking here is what I would do:

- Open up a local company, pay myself the minimum salary and keep the rest of the profits in a lower tax environment.

- Obtain proper Visa – probably this would be an investor or entrepreneurship visa (unless I wanted to go the permanent traveler route and skip step 1)

- Open up an Offshore company – held with the proper ownership so it didn’t create problems – with help of a lawyer who understood Japan.

- Buy, and not rent an apartment. I saw condominiums that were vastly underpriced in a good part of town. Yet to rent you will need a guarantor, and a number of other requirements such as several months upfront, and a fee to the landlord that is basically a gift to them.

- Learn Japanese from the outset. It appears that learning Japanese is absolutely essential in this society. While other countries around the world will have passable levels of English – I found very few expats who hadn’t taken the plunge. They seemed to suggest it was necessary if you wanted to make life livable.

Japan and the USA are similar in a number of ways as it relates to ownership of foreign entities and worldwide taxation.

- Can’t just use a nominee foreign corporate shareholder.

- Look through to related parties (can’t just hold in relatives name)

- CFC laws are robust and complicated

Despite thorough research, I don’t feel comfortable posting examples that would make sense in cogent detail.

Best would be to get specific advice for your unique situation. Here is a lawyer I can recommend: http://www.juridique.jp/

Hope this post was helpful in giving you an opinion on Japan.

Goodbye for now – Sayonara さよなら。