How to do a successful Initial Coin Offering (and not get sued)

(UPDATE: We’ve written a new article on where to set up a company and the proper corporate structure to run an Initial Coin Offering, check it out here.)

To IPO – or issue an initial public offering to the public is the time in which a private company (with only private shareholders, being accredited or professional investors, the founders, employees, advisors, and others with close ties to the public can access the public markets at large). In the public markets are hedge funds, and other retail investors who invest in stocks.

Hence, an IPO is a seminal event for a private company where leading up to this, millions are spent in due diligence, document preparation, and legal/filing/lawyer fees. Typically in the US, one would file with the SEC, and they would give permission to list on a stock exchange (the most popular being NASDAQ and NYSE).

However, in recent years, a new method of offering value in a company has become popular among hackers, with hundreds of millions in value raised. An ICO is often times without legal paperwork, without lawyers, and without the permission of any government agency (for better or worse).

So in order to examine the ICO model we look at this process vs. traditional methods of raising capital, and how to do it wrong, and finally tips on how to do it right.

What is an Initial Coin Offering (ICO)?

ICO or Initial Coin Offering is the unregulated means by which a start-up raises funds to start, develop or complete its cryptocurrency or its block-chain based software projects. Avoiding the difficulty and the rigorous and regulated processes to obtain funds through banks or venture capital investors. Explaining it in a simple way, the startups release tokens on a new cryptocurrency, that investors buy through existing digital currencies, usually Bitcoins or Ethers, or legal tender. So, the start-up can obtain financing for the development of the project. And investors expect those tokens to increase in value and get a high ROI.

Usually, in an Initial Coin Offering, the start-up issue a document presenting the service, product or solution concept, characteristics, added value, the existing needs that will cover when finalized, the amount of money required, the amount of virtual currency that the investors will keep, the accepted digital or fiduciary currencies and the duration of the ICO. If the campaign does not raise the minimum funding established, it fails and money is returned to investors.

Unlike an IPO, where shares represent a stake in the company, in an Initial Coin Offering, the tokens are usually new digital currency units. These can be traded for other currencies or for the purchase and use of certain products developed by the start-up or licenses to run the software developed. In some cases, some ICOs issue their tokens on existing digital currencies, where the tokens represent voting powers in the invested project.

During an ICO, the investors buy the tokens at a previous established price. Which may vary depending on the stage in which the ICO is. Where token price increases progressively as different investment thresholds are achieved. Encouraging and rewarding early investors.

The risk of this type of investment is considerable. There is no guarantee that the investor will get their money back, much less make a profit. Considering that in an ICO the tokens’ value is only supported by the trust and faith that the project will be successful. Failure to complete the project may mean the loss of the money invested.

Moreover, most countries lack regulation is an added risk. Permitting scams proliferation. Project owners may disappear with the money and the funds may be irrecoverable. Therefore, serious startups that launch their campaigns have self-imposed a code of practice, to be transparent enough and provide confidence to attract investors.

On the other hand, the main attraction of some of these investments is that the value of the tokens, once the project is developed, will be backed by a real and useful product. This is usually a guarantee of a substantial token price increase, and therefore a considerable ROI rate.

In 2013, Mastercoin launched the first Initial Coin Offering and raised more than $ 5 million in Bitcoins. Since then many campaigns have been launched. Of which some have been successful, like those of Ethereum and the most recent one (2016) Wave, that raised $18 million and $16 million respectively.

Regarding Ethereum, it was, without a doubt, the most successful. Ethereum is a decentralized platform that supports the creation of smart contracts agreements between peers, using its own cryptocurrency “Ether” to execute the contracts. The development of the Project was funded through an ICO during July and August 2014. The ICO managed to raise $18 million in Bitcoins, at $0.40 per Ether. The project was launched in 2015 and currently, the Ether has a value of more than $25 and a total capitalization of more than $2,000 million.

Long story short, as an investor you have to prudently perform due diligence, and as a founder- you should really make sure you don’t run afoul of securities (and other laws) because uncle sam can and will come after you.

For all the bad, there are some companies and foundations that have done a lot of good. For instance, Ethereum, Waves, others, have successfully leveraged an Initial Coin Offering to create entirely new business models. ICO’s in themselves are not bad, just as a gun isn’t bad by itself (only potentially dangerous, in the hands of wrongdoers and victims).

Traditional IPO Model

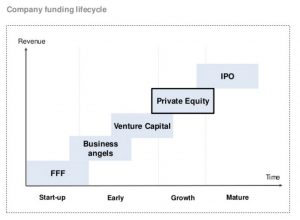

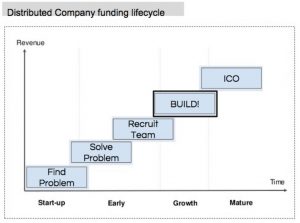

This process is called an “ICO” and it involves a company issuing a native token, in order to incentivize investors/users of the application to invest at the FRONT of a companies lifecycle

Compare these two timelines for an example:

Friends and family and fools take the first money in a company, then business angels, traditional venture capital funds typically come in at late seed series A through Series B or C, at which point private equity starts putting money in, until finally, an IPO happens.

How to do an Initial Coin Offering in the wrong way

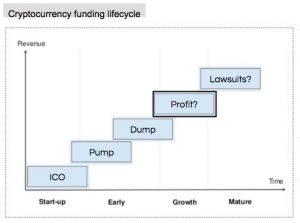

An ICO follows a very different model and looks more like this:

ICO’s are often done without any regulatory oversight and involve the direct sale of the future value of a company directly to the general public.

Sometimes the lack of scrutiny leads people to be bad actors, and pump up the price, only to ‘dump’ the stock in a major sell off, or worse run an outright pyramid scheme. This may lead to initial profit for the founders, but might also lead to lawsuits or criminal penalties. See GAW miners.

According to the SEC’s civil complaint, Homero Joshua Garza and his companies, GAW Miners and ZenMiner, sold more than 10,000 “investment contracts representing shares in the profits they claimed would be generated from using their purported computing power to ‘mine’ for virtual currency.”

Between August and December 2014, the companies sold $19 million worth of these contracts, dubbed “Hashlets.

As we’ll see later,  a security by any other name, still smells just as sweet, to the noses of inquiring SEC enforcement officers. ICO’s are not limited to people peddling new age categories, some simply brandish real stock and real promises of future profits. As you’ll soon see, this is a bad idea!

a security by any other name, still smells just as sweet, to the noses of inquiring SEC enforcement officers. ICO’s are not limited to people peddling new age categories, some simply brandish real stock and real promises of future profits. As you’ll soon see, this is a bad idea!

Or take for instance this totally different civil complaint accusing Chen of securities fraud he had initially offered investors “shares” in the company in April 2013:

Investors in USFIA received units of ownership in USFIA. Chen represented that these units would be convertible to USFIA common stock, on a 1:1 basis, when USFIA went public. Chen also told investors that when USFIA went public, its common stock would not be worth less than $20 per share. USFIA identified the units as “points” in the investor accounts it maintained on its computer system.

In addition to receiving units for points in USFIA, investors also typically received an amount of amber, purportedly equal to 30 percent of their investment. USFIA did sent (sic) the amber to investors, but upon obtaining appraisals of the amber, investors learned that the amber was practically worthless.

The streets are littered with failed startups that went belly up (or failed to even start):

- KnCMiner

- Crypt.sy

- Mtgox

- The infamous “DAO”

Next, I will show legal precedence and successful Initial Coin Offering cases (where people didn’t get sued or go to jail).

How to do a successful Initial Coin Offering (and not get sued)

At FlagTheory our mission is to help entrepreneurs succeed when it comes to the legal, tax, and compliance domains – especially when launching in a new market or dealing across borders. We help assemble lean teams of experts to bring success to your project. Next, we talk about how to (potentially) do a successful Initial Coin Offering within the bounds of the law.

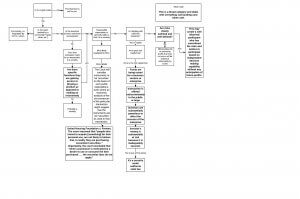

This picture is meant to serve as a better option for an ICO as opposed to those who are just scams. Typically for a successful Initial Coin Offering (for both the founders and token holders), there must be a problem where blockchain has a unique value proposition to solve this problem. There should be a team in place (largely this is what you are buying at this stage) and there should be work done, and evidence of work done.

An analysis of popular crypto-token issuance and actionable tips for your own ICO.

This is not legal advice, this is a generalized observation and not specific advice for your situation. Seek out personalized advice from an individual in your jurisdiction.

There is a fantastic new world of opportunity in the ‘blockchain’ world, one which allows for true automation and inclusiveness in finance. However, for a world of an entrepreneur there are a number of logistical hurdles involved in launching your decentralized application.

While the world of distributed ledgers, blockchains is a new one, there is a vast landscape of existing legal precedent that may apply to your situation, and professional counsel tailored for your specific situation is a good idea.

Legal hurdles to overcome (each of these will be a section below):

- Incorporation

- Terms and Conditions

- Securities Laws

- Commodities Laws

- Tax

- AML/KYC

- Consumer Protection

Incorporation

First and foremost it’s suggested that any company, operating as such – setup a legal entity and declare a jurisdiction, and venture for dispute resolution. By defining these terms from the outset, you clear any ambiguity. This does not preclude you from laws applying when dealing with certain laws of customers or investors who reside or a citizen of certain countries. However, leaving it without a legal entity exposes you to be classified as a general partnership, with general liability attached to each partner, jointly and severally. This is not ideal.

Picking a friendly jurisdiction, perhaps one with a regulatory sandbox which allows you to operate within the bounds of the law is the idea scenario. Even more ideal would be if you could secure a ‘non-action’ letter from a specific regulator, but these are burdensome to obtain and regulators will be reluctant to completely waive liability. In order to help pick a proper jurisdiction, you might compare the laws, the details in the companies act, and the securities regulator.

All this information (and more) is available for free at Incorporations.io.

(UPDATE: We’ve written a new article on where to set up a company and the proper corporate structure to run an Initial Coin Offering, check it out here.)

Terms and Conditions

Laying out clear terms and conditions that define risks, uses, warranties, liability and other core and fundamental legal issues is crucial to a successful Initial Coin Offering.

Nothing should be left to chance and one should make effort for every contingency to be defined. Taking the DAO approach of “law is code!” is a dangerous and oblivious action.

The terms and conditions should be the legal communication between your project and the public, and hence the language used is of significant import- but all the communication must be taken into consideration. If your terms and conditions are watertight, but the founder is tweeting “guaranteed returns, buy your ICO today!” then this may be noticed by regulators.

Securities Laws

Securities laws are complex and vary from jurisdiction to jurisdiction. However, the quick summary is that you generally would NOT want to be regulated as a security. {unless your asset is in fact a security, and you want to be treated as such). This would require registration in the United states with the SEC.

I have to give a hat tip to Dominic Williams who authored a fantastic article with in depth analysis of securities laws while this article was being written. I can summarize his suggestions down to 4 simple points that seem to cover “The Howey test” relatively well.

- The first thing to examine in a transaction is the motivation behind a token. Is the buyer’s primary motivation of buying the token that of investment or anticipated future profit? This is likely to be a security.

- Is this buyer interested for a minor asset, consumer good, or participation which helps the seller with early cash flow difficulties, or to advance a consumer purpose – this is obviously less likely to be construed by either the consumer or courts as a ‘security’.

- What is the plan of distribution? Is there common trading for speculation or investment.

- Thirdly, look to see what the reasonable expectations of the investing public would be.

- Finally – is there an existing regulatory scheme where the token sale can take shelter? This may reduce the risk of the instrument. (and is part of the reason why picking a jurisdiction and regulator is very important!)

What’s the TL;DR here? You want the buyers primary motivation to be consumption. There is relevant caselaw here: United Housing Foundation v. Forman

In this case, residents of a cooperative housing project sued a property developer, for the sale of unregistered securities (shares in the cooperative).

The Court in Forman noted that even though the instruments in question are called stock and the word “stock” is included in the definition of a security, the economic realities of the transaction are what need to be considered in light of the purposes of the securities laws. The court stated, “In holding that the name given to an instrument is not dispositive, we do not suggest that the name is wholly irrelevant to the decision whether it is a security. There may be occasions when the use of a traditional name such as ‘stocks’ or ‘bonds’ will lead a purchaser justifiably to assume that the federal securities laws apply. This would clearly be the case when the underlying transaction embodies some of the significant characteristics typically associated with the named instrument.”

The court reasoned that “people who intend to acquire only a residential apartment in a state-subsidized cooperative, for their personal use, are not likely to believe that, in reality, they are purchasing investment securities simply because the transaction is evidenced by something called a share of stock. . . . [T]he inducement…. was not to invest for profit.”

Importantly, the court concluded that “when a purchaser is motivated by a desire to use or consume the item purchased . . . the securities laws do not apply.”

Commodities laws

In jurisdictions where the asset being traded or sold – sometimes there can be a regulator who regulates commodities separately. In the United States, this would be the CFTC.

If your coin represents an underlying asset- then that asset may be regulated. For instance, if your coin is representing gold – which is a commodity, then it may fall under the purview of a commodities regulator.

Dgix DAO – Singapore incorporated company who trades gold has successfully fund-raised over 5m.

AML/KYC

One of the most difficult areas for a crowdsale owner to participate is the AML/KYC laws. If you are distributing coins to known terrorists or members who are on a watchlist (think OFAC, etc.) then you may be committing a crime. In the US this would fall under the jurisdiction of the Office of foreign assets and control, under the treasury department, who administers and enforces economic and trade sanctions.

There are certain jurisdictions which make KYC/AML easier to comply with than other jurisdictions.

Essentially know your customer laws require that owners of a company be identified by their government issued documents – absent of which, you may be considered to be aiding and abetting economic terrorism. If you don’t know their name, (or if they are a terrorist), then how could you be expected to perform sanctions screening? The law has an answer to this question, that you are still responsible to find out their name.

How much KYC should you collect?

If your company is a regulated entity, then there are laws or regulations prescribing the amount of KYC to collect (for instance, the government issued ID + a utility bill for a natural person). However, it is likely your entity may be considered non-regulated, in which case collecting KYC only needs to satisfy the minimum required by that jurisdiction. Again, this is complex as you may not be operating in any specific jurisdiction, which opens you up generally to any jurisdiction where they have residents who are investing or participating in your ICO.

Do you really need to collect KYC?

As cryptotokens are a new invention, laws have not caught up to the pace at which technology moves. Because of this – it’s a bit of a grey area whether KYC needs to be collected for an ICO or not. If you consider your ICO a security – then yes – absolutely KYC needs to be collected and also you need to determine whether the purchaser is an accredited or professional investor. However, if you consider your ICO as a token for use in your product – then typically there isn’t a requirement for you to check each and every customer. This could however be disputed, as while in daily commerce not every transaction is screened against sanctions lists – businesses are not allowed (or not legally allowed) to do business with someone who is on a sanctions list.

Money transmitter laws

Oy! This one is one we almost forgot, but it’s a doozy. Money transmitter laws in the US are regulated by FinCen and under the Bank Secrecy Act (BSA)

The latest ruling from the globally influential US regulator is an “administrative letter ruling” published on the FinCEN website, regarding “Persons Issuing Physical or Digital Negotiable Certificates of Ownership of Precious Metals.”

The Company provides Internet-based brokerage services between buyers and sellers of precious metals. The Company buys and sells precious metals on its own account. The Company holds precious metals in custody for buyers that purchase this service, opening a digital wallet for the Customer and issuing a digital proof of custody that can be linked to the Customer’s wallet on the Bitcoin blockchain ledger. The buyers can then trade or exchange its precious metals holdings at the Company by any means it could trade or exchange bitcoin, via the rails of the blockchain ledger.

Not all digital currency companies are classified as money transmitters, those that do should ensure compliance to avoid penalties and fees.

“the facts and circumstances, issues, and analyses that appear in an administrative letter ruling are of general interest to financial institutions then the letter ruling is published on our website,” said FinCEN.

FinCEN recognized “convertible virtual currency” as having an equivalent value to fiat currency, or acts as a substitute for fiat currency. Therefore, digital currency service providers must follow the same rules that fiat currency service providers do. The regulation does not differentiate between “real currencies” and “convertible virtual currencies.”

While digital currency transmitters are not exempt from FinCEN’s rules, users are excluded, including some miners.

“A person that creates units of this convertible virtual currency and uses it to purchase real or virtual goods and services is a user of the convertible virtual currency and not subject to regulation as a money transmitter.”

The definition is clear, companies offering brokerage services between buyers and sellers are often classified as money transmitters. However, FinCEN has some exceptions, “When a broker or dealer in currency or other commodities accepts and transmits funds solely for the purpose of effecting a bona fide purchase or sale of currency or other commodities for or with a customer, such person is not engaged as a business in the transfer of funds, and is not acting as a money transmitter as that term is defined in our regulations”

In such circumstances, the transmission of funds is a fundamental element of the actual transaction necessary to execute the contract for the purchase or sale of the currency or the other commodity. The transmission of funds is not a separate and discrete service provided in addition to the underlying transaction. It is a “necessary and integral part of the transaction.

What does this mean: you want to SELL a product, not facilitate money transfers.

Other approaches, if liquidity in and out is something you do want to provide.

Apply for MSL in multiple states.

Starting a Bank a class A banking license in Puerto Rico or St. Vincent is a somewhat expensive option.

Start a SVF – a stored value facility is a hybrid, commonly referred to as a ‘wallet’, and in Singapore, the laws are quite friendly. http://www.mas.gov.sg/singapore-financial-centre/payment-and-settlement-systems/payment-media/stored-value-facilities.aspx

Equity crowdfunding vs. Crowdfunding laws

Many jurisdictions have equity crowdfunding laws while still others have crowdfunding laws. The key distinction here between equity funding and product crowdfunding is whether some kind of security is being offered.

With equity crowdfunding, there is typically a lockup of 5 years or more before the company achieves a liquidity event. With an ICO, the token holders can typically liquidate their tokens within a much shorter time period. Niether crowdfunding or equity crowdfunding laws as written today represent fair and accurate description & governance of Token sales.

Beyond the US, other regulators are watching…

It makes good sense for you to go and have a chat with a local securities regulator in your jurisdiction. Lately, they have been setting up fintech contact points, and some even have a regulatory sandbox. In Canada, at least Ontario, the OSC is suggesting just that.

http://www.coindesk.com/ontario-securities-regulator-warning-ico-blockchain/

In statements, the Ontario Securities Commission (OSC) said on 8th March that the province’s laws may apply to ICO’s in some cases, advising companies that that utilize the tech to get in touch with them.

The OSC made references to initial coin offerings and said:

“Products or other assets that are tracked and traded as part of a distributed ledger may be securities, even if they do not represent shares of a company or ownership of an entity. Businesses’ specific use of [distributed ledger technology] may trigger Ontario securities law requirements, including the need to be registered or file a prospectus.”

Currency and Legal Tender

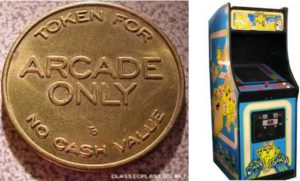

It might make good sense to avoid calling your app token a currency.

It might be OK to your app token a currency.

It might make MORE sense to avoid doing this, as shown by the Liberty dollars story.

Arcades in the US exchange tokens in exchange for dollars. They are NOT licensed money transmitters, and yet black helicopters haven’t descended to seize all of the tokens in the old ms. pac man game consoles.

However, on March 18, 2011, Bernard von NotHaus was pronounced guilty of “making coins resembling and similar to the United States coin” The FBI said:

Article I, section 8, clause 5 of the United States Constitution delegates

to Congress the power to coin money and to regulate the value thereof. It is a violation of federal law for individuals, such as von NotHaus, or organizations, such as NORFED, to create private coin or currency systems to compete with the official coinage and currency of the United States. {FBI press release}

Liberty Dollars used gold, sil ver, platinum, or copper to denominate certain value.

ver, platinum, or copper to denominate certain value.

However, it is not illegal to make private currencies, whether they are printed or minted (or spawned by an ethereum virtual machine), are ordinary statutes against fraud. SO why did these guys go to Jail?

Firstly, one can reasonably assume he was made an example of by federal agents. It’s not unfair to say that governments will look to ‘nip something in the bud’ with a visible show of force. For liberty Dollars, the outspoken founder von NotHaus was the founder of an organization called the National Organization for the Repeal of the Federal Reserve and Internal Revenue Code, commonly known as NORFED and also known as Liberty Services. Liberty services created Liberty Dollars were backed by a physical commodity—a weight in precious metal. And crucially, Liberty Dollars also differed from other alternative currencies in that they carried a suggested US dollar face value.

He faced up to fifteen years in prison, a $250,000 fine, $7 million worth of minted coins and precious metals confiscation to the government (this was later returned). A district Attorney in North Carolina, Anne M. Tompkins, described the Liberty Dollar as “a unique form of domestic terrorism” that is trying “to undermine the legitimate currency of this country”.The New York Sun. March 20, 2011. The Justice Department press release quotes her as saying: “While these forms of anti-government activities do not involve violence, they are every bit as insidious and represent a clear and present danger to the economic stability of this country.”

Lot of huff and puff and I’ll blow your house down! In the end, on December 2, 2014, he was sentenced to 6 months house arrest, with 3 years probation. That’s a pretty light bid if you ask me.

In an email, he stated that his probation has been terminated early and he is free. Termination of probation was granted December 9, 2015 by U.S. District Judge Voorhees: http://www.libertydollarnews.org/2015dec/BVNH_pt.pdf

When asked for his opinion he said: “This is the United States government. It’s got all the guns, all the surveillance, all the tanks, it has nuclear weapons, and it’s worried about some ex-surfer guy making his own money? Give me a break!”

Summary

There you have it folks. I’ll give you a break and summarize this into simple, concise actionable bullet points that will hopefully keep you out of jail, and allow you to ICO and profit with good intentions.

TL, DR

Generally Good Approaches

- Knowing your customer – using a company as a legal entity, not selling securities to non-professional/accredited investors

- If you must ICO, treat your Coin holders as participants, not investors

- Establishing a jurisdiction

Establishing a legal entity (so not treated by default as a partnership with unlimited liability).

Establishing a legal entity (so not treated by default as a partnership with unlimited liability).

Generally Bad Approaches

- No terms and conditions

- No incorporation

- No legal representation

- having ‘no’ jurisdiction or venue, allows courts to define where you operate

- Pyramid schemes with incentivization of multiple levels

- Calling your token “currency” or claiming to represent or replace a specific country’s legal tender

ICO Legal Structuring & Banking

Flag Theory is here to help you launch an Initial Coin Offering (ICO). We assemble teams to help with all of the legal, tax, compliance and banking issues you need to be aware of for both your company and its officers.

We are experts in cryptocurrencies and understand the legal workings that underpin an ICO. We will help you to set up your company for your ICO in the most favorable jurisdiction, designing the best corporate structure and selecting the places to setup it based on the unique complexities and number of options available to your specific situation.

We manage the implementation of the entire structure for you, so you have a complete turn-key solution rather than a bunch of pieces to try and put together on your own.

Flag Theory is the one stop shop to launch your Initial Coin Offering with the proper corporate, legal, tax and banking structure to remain compliant with the laws.

Click here for further details.

ICO Flowchart

Click the flowchart to enlarge