5 Golden Rules About Buying Gold

Rumor has it that the dollar may soon be backed by gold… The committee at next week’s US Republican convention is going to bring forth a proposal to return to the gold standard. This would be a monumental change in the way the monetary system functions in America.

Under a gold standard, the government and central bank are restricted from printing money because they must have an equal amount of gold in reserve. Since the US dollar was removed from the gold standard by Nixon, the government and central bank have had free reign to print dollars and inflate the currency.

Is it really even possible for the system to return to gold?

The total amount of gold in the world is 161,000 tons, according to Nat Geo’s Jan 2009 issue. 50% of that amount has been mined in the past 50 years. This figure is several years old, but estimates vary widely. So using this as an estimate – the total amount of gold in the world comes in at about 8 trillion. Under a true gold standard at current pricing, there isn’t enough gold to back the dollar.

The M2 money supply is about 10 trillion dollars. The amount of recorded debt is 16 trillion, and this doesn’t count off sheet liabilities. It’s doubtful that politicians would have the discipline to restrain their spending. I think this makes it even more doubtful that we will ever see the US dollar return to the gold standard.

Therefore, one of two scenarios would need to occur:

- Massive Deflation of the Monetary Supply

- Hyper Inflation of the Price of Gold

In the rare chance that there is a return to the gold standard by the US dollar (or China perhaps adopts a gold-backed currency) we would correspondingly witness a dramatic increase in the price of gold.

This is just one reason why I’m still buying gold. The practical aspects of gold: the limited supply, and increased demand make it infinitely more attractive than fiat currency.

Here are 5 rules to remember when investing in the gold market:

1) Physical Gold Above all Else

The very best place to hold gold is in a private allocated account outside the banking sector, in a vault or secure facility outside of your home country. The goal is internationalization of your self and your wealth – or Flag Theory. I’ve outlined several of the best countries to accomplish this here, and in the past, I’ve written about how to move gold overseas, and how to get an offshore bank account or a gold backed debit card – without even leaving home.

2) Volatility does not Equal Risk

Volatility in the gold sector does not necessarily equate to a risky investment. We know at this point that the gold market is also impacted (and indeed manipulated by greater market forces). What people don’t realize is that gold and silver are

“deliberately impacted by fake paper derivative markets in which prices are set with absolutely zero regard for the actual physical supply and physical demand” – ZeroHedge

If you see a bit of up and down, don’t bow out…

3) Stay the Course

When investing in any asset class, you should only be willing to buy assets which you feel have long term prospects for growth. If you want to trade in and out, that is fine – but that is trading, not investing. I invest to preserve capital.

Gold will continue the upward trend despite the ups and downs. We have seen a bull market in the last 10 years in gold, but overall the financial system has serious, systemic, and enormous flaws. Bankers cheated the public for decades with LIBOR… the amount of debt is staggering, and gold presents one of the very few ways in which you can hold a physical asset of tremendous value.

4) Ignore Misinformation

Whenever you do anything in life, it is vitally important to think for yourself. There is an incredible amount of information about all types of investments. You may have personal advisors (Who advise you not to internationalize) stock tips from friends, etc. Take them all with a grain of salt. Do your own research, and make an informed investment, not a gamble.

5) Make the Right Picks Within the Gold Vertical

Particular volatility can be found in junior mining companies and on paper gold, such as ETFs. These are more easily manipulated. However, since mining companies have taken such a pounding this year, now is again a good time to buy… to an extent.

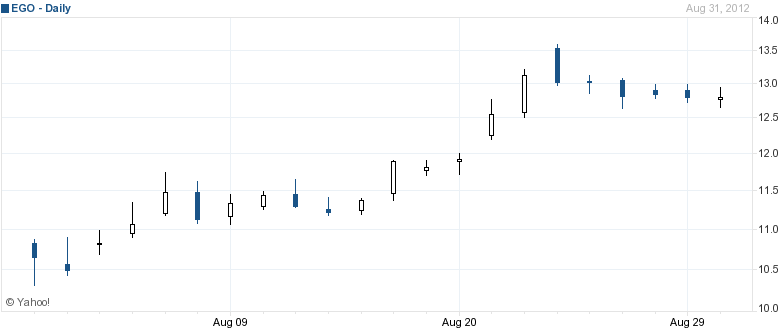

I’ll be blunt. I don’t trust the public markets anymore. There is too much deceit, lying and pilfering at the highest levels. With hedge funds who have servers located within the exchange, markets are easily manipulated. I’d much rather make an investment I can control (through a business or private equity arrangement) – but every once and a while I see something I can’t resist. For instance, when I bought Eldorado gold on July 25th, in the Guide to Gold, I suggested that my readers buy as well, after performing proper due diligence and going through executive reports. Stock in EGO has since risen 27.46% in the last 4 weeks since I made that signal. It also paid out a dividend in that monthly period.

I still believe EGO is a long term value play with room to grow.

Disclosure at time of publication: Long EGO