I am a Digital Nomad – Where should I set up a company?

This article was published on May 18, 2014 – we have recently (2018) published the ‘Where to set up an International Business’ article series, where you can find up to date information on international structuring options:

Where to set up an International Business

- Part 1: Offshore vs Onshore

- Part 2: Asia

- Part 3: The Americas

- Part 4: Europe

I’m location independent – Where should I incorporate a company?

This article is for the digital nomads, business backpackers and digital gypsies whose primary source of income comes from the Internet. “Permanent travelers”, PTs with a backpack and a business, to the Nouveau rich. [This article deals primarily with the 3rd flag of Flag Theory – An offshore company. Learn about the first flag (passport) or second flag (tax residency), fourth flag (offshore banking), fifth flag (physical assets), sixth flag (digital security) and seventh flag (digital assets). For a full outline of all 7 flags, Flag Theory The Foundation]. [As always, this is not tax or legal advice. Use common sense and consult with an attorney if you want to get specialized tax advice for your specific situation. This is my attempt to distill high-level concepts to present actionable options for incorporation.]

We also have an entire website and application dedicated to comparing international options to set up a company at incorporations.io:

Let’s dive into a few of the options you have with regards to the 3rd flag: Company.

Options to Incorporate

Anytime a business has customers or profits, you should have a corporate structure. As an entrepreneur – you already know this. You are a traveler – and freedom and autonomy are important to you, and you prefer if the paperwork involved were minimal. Taxes are somewhat of an afterthought, but you want a structure that will last for the long haul. You’ve got options, but first, let’s start with what you should NOT do. Here are some options for each of the following:

- Option 1: Sole Proprietorship or General Partnership

- Option 2: LLC in high tax jurisdiction.

- Option 3: Offshore Company

- Option 4: Corporate Structure with Multiple Entities

Option 1: Sole Proprietorship or General Partnership

Running a business as a sole proprietorship or general partnership is a common mistake for those just getting started… I know a person who runs his entire business as a sole proprietorship in Australia. By default, he is opening himself up to unlimited liability, at no benefit. What does unlimited liability mean? This means you are open to personal bankruptcy should someone sue your business. However, when you set up a Limited liability company (or a company limited by shares), your liability is generally limited to the capitalization or contributed capital (the amount you put into the company). A scenario potentially worse than a sole proprietorship is a general partnership – the default legal structure for a business run by 2 or more owners. A General Partnership exposes you to the liability of your partner(s) – where you are both jointly and severally responsible for the debts, obligations, and liabilities of ALL other partners. A sole proprietorship or general partnership offers no benefits or protection. Long story short – set up a Company for a business, and you can protect yourself by creating a corporate veil. Let’s quickly get on to more interesting and relevant setups, since this one should never be used.

Option 2: LLC Onshore

This is a preferred setup for someone just getting started. Forming an LLC in the United States (or Australia, or New Zealand) is relatively straightforward, and should cost you less than $1000 dollars. If you have a partner in the business, take some time to get proper documents drafted such as an operating agreement, and optional founders agreement, which creates a basis for corporate governance. An LLC or corporation set up in your home country or base is a good way to get started, especially before you are living a fully nomadic lifestyle. Now you can claim deductible expenses, and you have liability protection (to some extent) from staff, customers, or competitors if and when you are ever sued. If you are from the USA – Wyoming is a particularly good state to form an LLC. Other popular states include Nevada and Delaware – but they are expensive, charging $350 and $400 per year as a franchise fee (state tax) – whereas year 2 state tax is generally limited to just $50 in Wyoming. Bottom line: this simple setup is good to get going, and provides some level of protection. However, there are more optimal structures for PTs who are able to spend the majority of the time on the road, and those who have established a residency flag in a tax-favorable jurisdiction.

Option 3: Offshore Company

Here’s where it gets interesting… Let’s assume you are able to establish a residency in a low or no tax jurisdiction (or one with a territorial tax regime). An offshore company might be of great benefit to you. However, check with a local attorney or tax advisor if you own or are planning to own an interest in any legal entity.

Benefits of an offshore company

- Access to Merchant Banking options

- Retain profits offshore

- Potential tax advantages

- Additional Liability Protection

For Americans

Americans: you have a worldwide tax obligation and I sincerely urge you with extreme prejudice to talk to a lawyer/accountant before you go offshore. You can get a great benefit from an international or “offshore company” from a liability perspective, but the tax situation is complicated (especially when compared to other expats). There is a significant amount of forms required for reporting ownership or control of a foreign corporation or bank accounts, including form 5471, 8938, TDF 90-221 and others. If you need an expat tax advisor, I recommend David Mckeegan from Greenback Tax Services, Vincenzo Villemena from OnlineTaxman.com

For Everyone Else

Expats or those who live abroad will again, most likely, get the most benefit by first establishing residency in a no tax jurisdiction, or one that doesn’t tax profits derived outside the country, also known as a territorial tax regime. After you do this, you can get great benefit from an offshore company. However, you’ll first need to establish a residency in a low tax jurisdiction. This is covered in depth in the 2nd book “Residency” – available only if you join the PT Society. Some countries you might want to consider are Monaco, Thailand, Indonesia, Vietnam, while a more in-depth explanation can be found here: Is your corporation really tax-free? Flag Theory is an interconnected system; there is no “one size fits all” solution, or “single best” option for incorporation. The types of things you want to think about when determining the proper offshore company, legal entity or holding company include:

- Jurisdictional reputation

- Tax treaties and tax treatment

- Access to high-quality banking

- Lack of capital controls

- Asset and liability protection

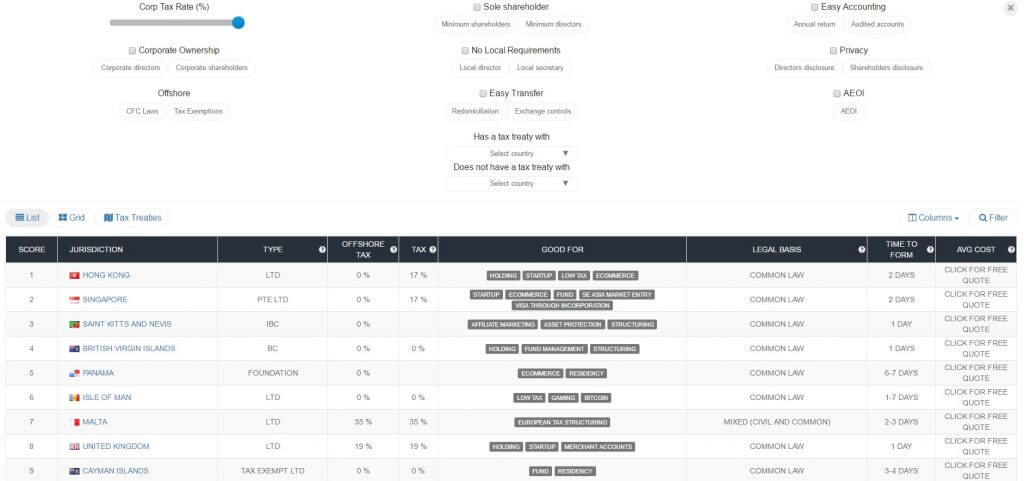

Jurisdictions for an offshore company

- Singapore Company Formation

- BVI Company Formation

- Belize IBC / LLC Formation

- Nevis LLC Formation

- Wyoming LLC Company Formation

- Go Offshore like Google (Ireland + Netherlands + Bermuda)

You might consider using a mail drop box to make your business “appear” as if it were in another jurisdiction. For instance, you could set up a company in BVI with a Hong Kong bank account and address. Then you wouldn’t need to deal with yearly auditing in Hong Kong, but your customers might assume they are wiring money to an HK business, particularly if the mailing address and bank account appear to be for an HK company. Perfectly legal, intelligent and legitimate way to get a great business address, and lessen your compliance or paperwork burden. Offshore companies work best in conjunction with an onshore entity. This is what behemoth fortune 100 companies do for tax advantages. And while a digital nomad in particular can get a great benefit from an offshore company, there are instances where an onshore entity, or more complex structure combining an onshore and offshore entity, could be preferred. For instance, what if a business wants to level up and take on investment, or establish a physical office, or those that require a significant amount of human capital…

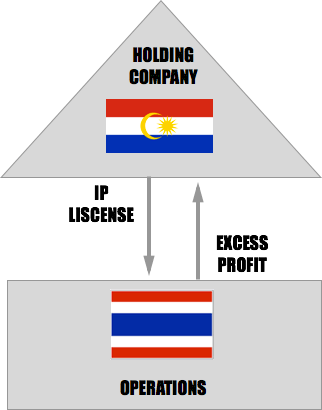

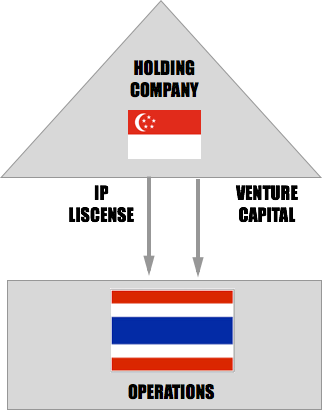

Option 4: Corporate Structuring

It might also make sense to combine your offshore company with an onshore entity.

- Corporate Structuring Philippines I

- Corporate Structuring Philippines II [Infographic]

- Corporate Structuring Thailand I [Infographic] – Offshore Company

- Corporate Structuring Thailand II [Infographic] – BOI Company

A physical headquarters is particularly useful for establishing residency, taking on loans or venture capital, hiring staff or other “location dependent” businesses. Other benefits include health insurance, greater reputation and potential for M&A or exit opportunities, and compliance with local laws and regulations. The question becomes: how long can you keep traveling indefinitely, or rather – Where is the best strategic place for me to start a business, and plant a residency flag. Some of these countries, such as New Zealand and Singapore, even have fast-track citizenship programs for those willing to move there and start a business, meaning within just 3 years – you can get a new passport.

These governments were smart enough to grant residency status and special investor visas for those who wish to set up a business and face a small amount of tax. Having an offshore company is a step in the right direction for many digital nomads or location-independent businesses. But an onshore company presents an opportunity. What if you could have the best of both worlds – 0% tax, and an onshore entity. Under the Thailand Board of Investment scheme, you can set up a company and receive an 8-year tax exemption (which can be further extended to 11 years). This isn’t for those just starting out (you’ll need to invest about $8000 to get started – and you can use this money to buy/rent a home office/car) but it’s a great opportunity to get:

- Long term business visa

- Work permit

- health insurance

- employees

- “onshore” entity with 0% tax

This set up puts you firmly and legally in one place so you can start building a team… a business… a residence… a life. There is a growing trend among digital nomads to actually set up shop in a location instead of drifting from country to country, going on visa runs (is there any bigger waste of time) or wondering if their set-up is “legit”. Take a look at Evil Genius Technology in Vietnam or Mailbird based in Bali Indonesia. These are companies and individuals who are making good use of the currency arbitrage opportunities, great local talent, and emerging economic growth of SE Asia with physical offices on location.

There are advantages to be had on shore as well, without the stigma or difficulty of offshore business. For example, Thailand grants an 8-year tax exemption for those who are approved by the government. This is also known as a BOI company. While it can be difficult to obtain, we have the proper channels to facilitate your application process. Here are the benefits of a (truly) Tax-Free Company in Thailand.

Company Benefits

- 0% tax for the first 8 years

- 3 years of additional tax benefits

- permission to own up to _ Rai of land

- 100% ownership in the company

- social security and health insurance for employees

Personal Benefits

- 1-3 year work permit possible

- 1-3 year visa possible

- diplomatic entry to BKK airport

- permission to own up to _ Rai of land

- social security and health insurance

In addition, the BOI has a different line at immigration to process visas and work permits. It is also worthwhile to think about where your domain is registered, hosted, and where you have addresses listed for your business. Someone (either yourself or a juristic person such as a legal entity) read: LLC owns your intellectual property, as well as the liability for your business. Thailand is just one option for incorporating an “onshore” entity that can potentially be tax-free, or offer special benefits afforded by the government. There are also options such as setting up a company in Singapore to receive an entrepass or in New Zealand for an entrepreneur visa. With either of these options, it is possible to obtain residency (and eventual passport) in said jurisdiction.

TL;DR

- Avoid using a sole proprietorship set up.

- An LLC is a good way to get started. Wyoming is a fantastic place to incorporate if you are American.

- Americans – it’s complicated. Talk to a lawyer. Everyone else, you probably need a low tax residency to make full use of an offshore company, although some expats are relieved of prior tax burdens in other ways.

- A more complex onshore/offshore corporate structure helps eliminate any “grey areas”, establish residency, and provide additional incentives for the owners. If your business can support, this might be worth exploring. If you’d like to set up a call to talk about your unique situation, contact us or check how we can help you.