Where to Set Up a Foundation for an ICO (a comparative analysis)

One of the most suitable legal entities for holding a token sale or an “ICO” – initial token offering is a foundation. We’ve written previously about how to do a successful token sale from a legal perspective and the potential pitfalls to watch out for. We’ve edited a spreadsheet to score your ICO as to whether it’s a token for use or a security and written an article on corporate structuring for ICOs.

Now we examine a particular type of legal entity and its usefulness in a token sale: A foundation.

A foundation is originally a construct of civil law, but many common law jurisdictions have created legislation to allow foundations in their country.

What is a Foundation

A foundation is a nonprofit organization which is generally established to reflect the wishes of the Founder via an endowment of assets, which are managed by the council members for a specific purpose and/or for the benefit of its beneficiaries.

They are hybrid in nature, containing features of the corporation (legal personality) and the trust (created for a purpose or benefit).

Generally, a foundation includes the following:

- Founder – the natural person or body corporate who establishes the Foundation

- Council – the natural persons or body corporate who sit on the board and carries out the purpose of the foundation as instructed by the Charter (a council functions similarly to board of directors for a company limited by shares)

- Members – They elect the council. However, typically under foundation law, the members have no rights to profits of any kind.

- Protector – the natural person or body corporate who oversees the foundation’s council and ensure that carries out its functions (sometimes called enforcer or guardian). In most jurisdictions is optional.

- Beneficiaries – Some types of foundations mandate that there are specific beneficiaries, and other foundations only exist for a purpose. For the purposes of a foundation for a token sale – it’s exceptionally important that the jurisdiction allows for a foundation to exist for a purpose (as there are reasons not to name specific beneficiaries).

- Charter – Where the governing rules of the foundation are set out, including its purpose, council members, protector and beneficiaries (sometimes called the constitution, articles, or founding charter).

In some jurisdictions, a foundation may acquire its legal personality when it is entered in a public registry, while in other countries a foundation may acquire legal personality by the mere act of creation through a required document.

Unlike a company, foundations have no shareholders, though they may have a board, an assembly, and voting members.

A foundation may hold assets in its own name for the purposes set out in its constitutive documents, and its administration and operation are carried out by the Council Members in accordance with the Foundation statutes or articles of association rather than fiduciary principles.

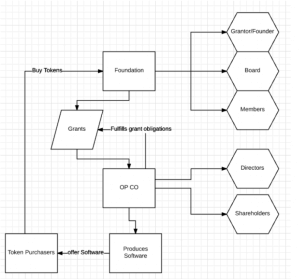

A Foundation is a suitable entity to hold a token sale and/or manage its proceeds due to its unique characteristics:

- Non-profit organization.

- No owners/shareholders.

- It can be solely established to carry out a purpose and not for the benefit of persons.

- Provides for a perpetuity of purpose.

Things to consider when looking at the right jurisdiction for your foundation:

(in no particular order)

- Reputability: Political and economic stability, transparency, justice, market and individuals’ freedom.

- Time: Procedures needed to set up the Foundation.

- Taxation: Whether the transfer of assets/donations to the Foundation or income earned is subject to tax or not.

- Securities laws: Although, whether your token would be considered a security or not will be determined by the jurisdiction where token purchasers are located, is relevant that the securities laws of the country where the issuer is incorporated have a clear and delimited definition of security, in which your tokens do not fall into.

- Blockchain regulation: Whether there is a Regulatory Sandbox with enough flexibility for your blockchain project to be regulated.

- Foundations law: Legal aspects to consider such as initial patrimony required, if it can be solely established for a purpose rather than for the benefit of a person/s, foundation structure flexibility, among others.

Now, let’s analyze some common jurisdictions:

Switzerland

Overview

A Swiss foundation was home to the first successful ICO when Ethereum launched several years ago. The Swiss law provides a flexible foundation law framework, however, there are several downsides to hold a token sale in a Swiss foundation.

Reputability

Switzerland is a high-reputation jurisdiction with an old tradition of political and economic stability. Switzerland is one of the most developed and prosperous countries worldwide, with a highly skilled labor force, one of the largest financial centers worldwide, and home to some of the most important multinational corporations.

Switzerland is a high-reputation jurisdiction with an old tradition of political and economic stability. Switzerland is one of the most developed and prosperous countries worldwide, with a highly skilled labor force, one of the largest financial centers worldwide, and home to some of the most important multinational corporations.

Switzerland ranks 4th in the Heritage Foundation’s Index of Economic Freedom, 5th lowest Corruption Perception by Transparency International and one of the freest countries according to Freedom House report.

Time to form

Usually, it takes about five to ten days to get all the necessary papers, draft the documents and passing the necessary resolutions with the notary public as well as filing it with the commercial register.

However, the unpredictable part is the opening of bank accounts with Swiss banks and obtaining the approval of the supervisory authorities for foundations.

It may become difficult and cumbersome to open the Swiss bank account for a Foundation that will receive proceeds from an ICO, hence, to set up a Swiss foundation. Every foundation must, after it has been set up, be approved by the supervisory authority and they want to see a Swiss bank statement confirming the initial foundation capital. If they are not satisfied with what they receive, they can dissolve the foundation.

Taxation

Foundations in Switzerland are NOT exempt from tax automatically and must apply for an exemption based on the facts and circumstances of the foundation.

If the purpose of the foundation is approved as charitable and profits of the foundation are solely distributed to nonprofit organizations or projects, a tax exemption may be granted.

If not, donations to the Foundation may be subject to Gift tax, and corporate income tax on their income received.

To be tax-exempt Foundations must conduct activities of a charitable, humanitarian, health, ecological, educational, scientific or cultural nature and have an unrestricted circle of beneficiaries; or be of no self-interest, serving the public interest and based on altruism to the community.

The Securities Framework

Switzerland does not have a unique law regulating securities.

The main Swiss body of law the Swiss Code of Obligations, which has three sections with special relevance: Art 620 et seq CO with provisions on corporations; Art 620 et seq, CO on equity securities; and Art 965 et seq. CO on negotiable (which may include both equity and debt).

There is also the Federal Act on Stock Exchanges and Securities Trading, regulating public securities. As per the Act, Securities are defined as: “ Securities shall mean standardized certificates which are suitable for mass trading, rights not represented by a certificate with similar functions (book-entry securities) and derivatives “

Although the Swiss Financial Market Supervisory Authority (FINMA) stated that digital tokens were not securities, this decision was specifically related to Ethereum, therefore could only be extended in certain ways to use tokens.

In any case, this decision could not apply to many ICO that may fall into the broad definition of securities of the Swiss regulations:

«Whether companies require permission from FINMA depends on the activities it conducts in Switzerland and has to be evaluated on a case-by-case basis,» – quote from FINMA from the recent FI news article.

As stated in the FINMA Guidance 04/2017 on the Regulatory treatment of initial coin offerings, September 29th:

Provisions on combating money laundering and terrorist financing:

- the Anti-Money Laundering Act applies where the creation of a token by an ICO vendor involves issuing a payment instrument. If this is the case, other supervisory issues may be effective for third parties, especially for professional crypto brokers or trading platforms which carry out 3/4 exchange transactions or transfers with tokens (secondary trading with tokens).

- Banking law provisions: accepting public deposits where an obligation towards participants arises for the ICO operator because of the ICO generally necessitates a banking license.

- Provisions on securities trading: a licensing requirement to operate as a securities dealer may exist where the tokens issued qualify as securities (e.g. derivatives).

- Provisions set out in collective investment schemes legislation: potential links to collective investment schemes legislation may arise where the assets collected as part of the ICO are managed externally.

The institution is currently investigating a number of ICO cases to determine whether regulatory provisions have been breached.

Regulatory Sandbox

Switzerland does have a Regulatory Sandbox License to support technological innovation, such as blockchain implementation in the financial services area. However, this sandbox license is specifically aimed at companies conducting banking activities that do not hold more than CHF 50 million in deposits and have at least €300,000 of capital as collateral.

Therefore, it certainly does not fit to most projects conducting ICOs.

Foundation laws

A foundation in Switzerland is established by public deed and requires a minimum initial contribution of CHF 50,000. It can be set for a specific purpose and is not required to appoint beneficiaries.

The founder, who can be either a body corporate or an individual, can be appointed as president of the Foundation board.

At least one council member with signing powers must be domiciled in Switzerland. Council members details are available in a public registry.

The articles of Association, which governs the Foundation can only be amended in very special circumstances and with the approval of the FINMA.

A Swiss foundation shall appoint an independent and chartered auditor that shall review the annual accounts of the foundation

Unless two or more of the following values have been exceeded (total balance sheet: CHF20 million; turnover: CHF40 million; staff: 250 full-time employees on average annually) during two successive business years, the foundation may be subject to a limited statutory audit instead of an ordinary audit.

The FINMA can waive the audit requirement when the foundation does not solicit public funding and its total balance sheet for two successive years amounts to less than CHF 200,000.

Singapore

Overview

ICO’s are oftentimes done in a non-profit entity or other such entity that does not have shares. Companies limited by guarantee (CLG) do not have any shareholders but are not a foundation per se. The popular place to do these up until some weeks ago was Singapore.

To be considered as a non-profit, Public Companies Limited by Guarantee (CLG) must not have beneficiaries and any surplus (profits) made by the CLG must be retained in the company and is prohibited to make any monetary distribution to its members or directors.

A CLG is managed by a board of trustees, which is similar to a Foundation council.

Reputability

Singapore is also one of the most political and economic stable jurisdictions worldwide.

Singapore is one of the main global cities and one of the hubs of world trade, with the third largest financial center and one of the largest freight port worldwide.

It is the third country with the highest per capita income (PPP) worldwide, as well as being among the first countries on the international lists of education, with one of the highest skilled workforce worldwide, health, political transparency and economic freedom and competitiveness.

Time to form

Incorporate a public company limited by guarantee and get the non-profit status may take more than two weeks.

Taxation

There is no automatic exemption or tax-free status given to CLGs in Singapore.

Usually, a company limited by guarantee in Singapore would be exempt from income tax if profits are from members’ contributions; or if over 50% of the company’s gross income is from members and are not tax-deductible for them.

For a full tax-free status, the company must apply to the IRAS for Charity status after its registration.

Securities Framework

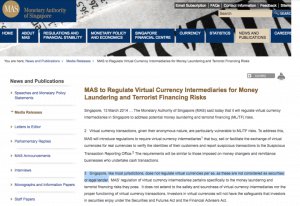

The Monetary Authority of Singapore has ruled that a token is an asset (not a security, 2014). There is no precedent of MAS taking punitive action against a token project.

Previously on March 13th, 2014, the regulator wrote that virtual currencies were not regulated per se, and they are not securities.

Now, from 2014 the position was very clear – tokens are not securities.

However, a memo sent out in August 2017 states that tokens may be considered securities, depending on the individual circumstances. Now, this doesn’t officially change anything (a token could have been a security before) but clarifies and specifies the point that tokens may at times, fall under securities regulation – basically the same as the SEC ruling.

Singapore regulators are well abreast of the implications of securities tokens and MAS is probably one of the most advanced regulators in the world. Uniquely, they also govern banking, securities and multiple sectors – which makes them easier to approach and engage with.

Regulatory Sandbox

Singapore has a Fintech Regulatory Sandbox, aimed exclusively at companies innovating in the financial services sector.

Company laws

Public company limited by guarantee is incorporated by at least three members, who may be a body corporate or individuals.

There is no minimum monetary contribution, but members must give an undertaking (guarantee) to pay a certain amount if the company is in liquidation. The guarantee may be as low as SGD 1.

There should be at least 3 governing board members, and at least 1 must be a Singaporean citizen or permanent resident. One local secretary is required.

Details of founders and board members are available to the public.

Public companies limited by guarantee are required to prepare and maintain financial statements, and file them in their annual return to the Accounting and Corporate Regulatory Authority (ACRA) and pay the annual filing fee.

Accounts must be audited by a Singapore Certified Public Accountant.

CLGs are required to file annually their tax return to the Inland Revenue Authority Of Singapore (IRAS).

Panama

Overview

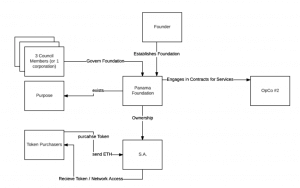

A Panamanian S.A. will be established to conduct operations, this specific S.A. will be created with the principal amount of $50,000.00 as a requirement for the Exchange House License of “Direccion General de Empresas Financieras”. A check has to be written for the National Treasury for an amount of $1,000.

A Panamanian Private Interest Foundation will be the owner of the Panamanian S.A. shares, also will hold the by-law document and regulate the operations of the Panamanian, S.A.

Exchange License for the Panamanian S.A: The authorized company can operate a gold trade or virtual currency exchange in which you accept payments of any form for the purchase and sale of digital coins.

There are some restrictions as to the activities of the S.A.

- Debt Collection: Cannot operate as a collection agency (although you are allowed to do factoring business).

- Fiduciary Firm: Cannot act as a proxy or exercise your fiduciary activity, as it requires a different type of Financial Services / Trust Services License and together with a minimum capitalization of US $ 250,000.

- Banking: Not a bank and cannot accept deposits or engage in banking without a bank license. Banks provide checking accounts, take deposits directly, make personal and other loans, underwrite mortgages, etc. Banks require a minimum capitalization of US $. 1,000,000 and are subject to very strict regulation and supervision.

- Securities Broker: Cannot be a stockbroker with this license.

- Financial Management Services: Cannot offer accounting or bookkeeping services.

Reputability

Panama’s economy is one of the most stable in Latin America and the largest trade and financial center of the region.

Its conglomerate of transport and logistics services are oriented towards world trade, whose epicenter is the Panama Canal, where there are ports of transshipment of containers, free zones of commerce, railroad and the largest air hub of passengers of Latin America.

Its international prestige was somewhat affected by the Panama Papers scandal, and although it has similar corporate legal frameworks as Hong Kong or Singapore, it does not enjoy the same international reputation, nor the same levels of economic freedom.

Time to form

Incorporate an S.A. and a Foundation in Panama may take about two-three weeks. Once you get your corporate documents, expect between three or four weeks more if you wish to do banking in Panama, as we will see below.

Taxation

Taxation

A Panama Private Interest Foundation is exempt from income taxes, provided that no residents of Panama benefit from the Foundation and no physical assets held in the Foundation are located in Panama.

Foundations are subject to a registration fee of US$350 and an annual franchise tax US$400.

Securities Framework

The securities market in Panama is regulated by Decreto Ley 1 del 8 de julio de 1999 (Law Decree 1 of 1999) (as amended), known as the Securities Act, and supervised by the Superintendencia del Mercado de Valores (Superintendency of the Securities Market).

According to the Securities Act, a security is defined as:

A security is any bond, negotiable commercial security or other debt security, share (including treasury stock), stock exchange right recognized in a custody account, participation fee, participation certificate, securitization certificate, fiduciary certificate, certificate of deposit, mortgage instrument, option and any other instrument, instrument or right commonly recognized as a security or determined by the Commission as a value.

This expression does not include the following instruments: (1) Non-negotiable certificates or securities representing bonds issued by banks to their customers as part of the usual banking services offered by such banks, such as non-negotiable certificates of deposit. This exception does not include negotiable bank acceptances or marketable securities issued by banking institutions.

(2) Insurance policies, certificates of capitalization and similar obligations issued by insurance companies. (3) Any other instruments, titles or rights which the Commission has determined that are not securities.

Regulatory Sandbox

There is no regulatory sandbox in Panama.

Foundation laws

The Founder is the person who presents the articles and registers the Foundation in the Public Registry of Panama. The founder may not have influence over the control of the Foundation.

The minimum contribution may not be less than US$10,000, in assets or cash, and may be denominated in any legal currency. The foundation may be set up without assets provided that there is an undertaking that assets will be transferred after the foundation is set up.

The Foundation is administered by its ‘Counsel’. The Counsel must be either Three (3) individuals or One (1) Panamanian Company. All three individuals can be of any nationality. The council members are each registered in the public registry with their names, addresses, and identifications. If privacy is necessary, the owners of the company can be kept private. The Counsel is in charge of the Foundation and it is highly recommended that either the 3 individuals and/or the company is made up of highly trusted individuals.

Panama Private Interest Foundations may be instituted for the benefit of individuals or a specific purpose.

Foundations must keep accounting records and underlying documentation, which must be available for 5 years. Records may be kept at the office of the resident agent in Panama, or at any other place determined by the council members. Foundations are not required to file accounts, annual return or tax return, provided that they do not hold assets or conduct activities in Panama.

Mauritius

Overview

Mauritius is an island country located in the Indian Ocean, a renowned financial services center with one of the highest per capita income in the entire African continent. Mauritius is called the “Ethereum Island” and is becoming an international hub for blockchain startups.

Its board of investment has publicly announced their desire to attract blockchain startups to their country. There is a sandbox which can be applied for, which can help startups who would not fall into a regulated environment elsewhere apply for a license.

Reputability

Mauritius is a politically stable jurisdiction, highly ranked for democracy and for economic and political freedom. It is the largest international financial and business hub in the Indian Ocean region with a strong liberal economy, a reputable banking system and a wide offer of qualified professional services, and a pro-business and flexible regulatory framework that provides reliability and security.

Mauritius is a non-Black-listed jurisdiction and is not considered as a non-cooperative country by the Financial Action Task Force.

However, although it enjoys a high prestige between business circles, maybe, unfounded or based on ignorance, perceived negatively as a shady offshore tax haven by the crowd.

Time to form

A foundation in Mauritius can be set up in a relatively short amount of time, just a few days.

Taxation

A Foundation of which the founder is a non-resident or holds a Category 1 Global Business License under the Financial Services Act; and all the beneficiaries appointed under the terms of a charter or a will, are, throughout an income year, non-resident or hold a Category 1 Global Business License under the Financial Services Act, shall be exempt from income tax in respect of that year.

For the purpose of the exemption, any Foundation shall deposit a declaration of nonresidence for any income year with the Director-General within 3 months from the expiry of the income year.

Foundations are subject to a registration fee (US$350) and an annual government fee (US$350).

Securities Framework

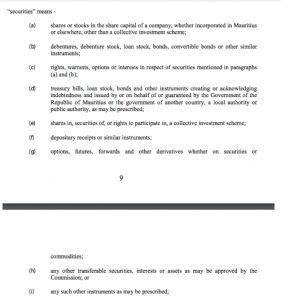

Furthermore, the securities laws in Mauritius are favorable.

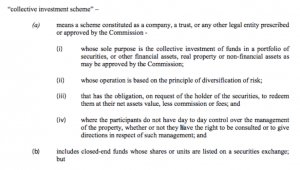

According to the Securities Act:

The above is straightforward and self-explanatory, and a utility token could not fall into these definitions. There is one additional area which could be a potential security, and that is a “collective investment scheme”.

As we have seen, there is a clear definition of securities and collective investment scheme, which adds a level of predictability that your utility token may not fall into these regulations.

Regulatory Sandbox

The Regulatory Sandbox License (RSL) launched in Oct 2016, and provides companies and startups with the opportunity to test innovative products, services, business models and delivery mechanisms in the real market, with real consumers, but with regulatory supervision.

The Mauritius board of investment has publicly announced their desire to attract blockchain startups to Mauritius.

Unlike other jurisdictions such as Switzerland, the UK and Singapore, where their sandboxes are aimed at companies conducting financial services activities, the RSL in Mauritius is available not only for entities innovating in fields related to financial technology, also in digital identities, digital currency, online healthcare, blockchain and decentralization systems of information, among others.

There is a selection criterion for RSL as well as several conditions related to the activity such as safeguards, terms and conditions, compliance with existing regulations referring to the general business operation, monitoring mechanisms, among others.

This regulatory sandbox framework makes Mauritius one of the most attractive jurisdictions for entities of the blockchain space that are seeking to be regulated.

Foundation laws

A Foundation in Mauritius may be established for the benefit of persons, class of persons, and/or to carry out a purpose which may be charitable, non-charitable or both.

The founder may be a juristic or a natural person. There is no minimum initial contribution to establish a Foundation in Mauritius.

The Foundation shall have a Council which is responsible for administering the property of the Foundation and carrying out its objects in accordance with its Charter, the Articles if any, and the Foundations Act. The foundation charter can be changed once it is set up.

The Council shall have at least one member who must be ordinarily resident in Mauritius and may be either individuals or juristic persons.

Appointment of a secretary is required, who shall be a management company or such other person resident in Mauritius as may be authorized by the Financial Services Commission.

Details of the founder, council members and beneficiaries are not disclosed in a public registry. Any person who has acquired information in his capacity as an officer, a protector or a member of a Council shall treat the information as confidential.

A foundation must keep sufficient accounting records to show and explain the transactions of the foundation, disclose with reasonable accuracy the financial position of the foundation and allow financial statements to be prepared.

These documents shall be available for inspection by any founder, officer, and supervisory person, the Registrar or the Commission during business hours.

Conclusions

Due to its non-profit nature and the fact that does not have shareholders/owners, a Foundation is a suitable entity to perform the token sale and/or the ongoing custodial duties post-sale.

We have reviewed several jurisdictions, and each one has strengths and weaknesses.

Switzerland may be the highest reputable, but the fact that it may be considered a taxable entity, its securities framework and recent statements from FINMA, its costs and tedious procedures to set up and maintain, do not play in its favor.

Singapore is also high-reputable jurisdiction, and although recent statements of MAS are not much encouraging there is no precedent of MAS taking punitive action against a token project.

However, a company limited by guarantee may be considered as a taxable entity and its regulatory sandbox is limited to financial services activities.

Panama Foundations are one of the most private and flexible foundation structures and are exempted from taxes. In combination with a Panamanian S.A. holding an Exchange License, it can operate a virtual currency exchange accepting payments of any form for the purchase and sale of digital coins.

Mauritius called the ‘Ethereum Island’, may be the most ICO friendly jurisdiction, with a flexible and open Regulatory Sandbox from which they can benefit entities innovating through cryptocurrencies and blockchain that want to be regulated. But, despite being a renowned financial center, it does not have the reputation of jurisdictions such as Switzerland or Singapore.

Malta, Isle of Man, Cayman Islands, Gibraltar, Liechtenstein or Labuan are some other jurisdictions to consider for ICO purposes. If you are interested in conducting an initial coin offering (ICO) and want to select a favorable jurisdiction, we will help you to compare the most suitable corporate structure based on some of the unique complexities and number of options available to your specific situation.

Regulatory bodies are closely monitoring ICOs, and care must be taken to not break any of the existing laws. At Flag Theory, we provide ICO consulting including legal structuring through our network of top-notch legal advisors to remain compliant.

We can manage the implementation of the entire corporate structure for you, so you have a complete turn-key solution rather than a bunch of pieces to try and put together on your own.

We invite you to learn more about our ICO Legal Structuring & Banking Solutions and have a call to understand your situation and goals and explore suitable options according to your specific circumstances.